How Emphasizing ESG Affects Firm Value

Reynolds Holding

JANUARY 16, 2024

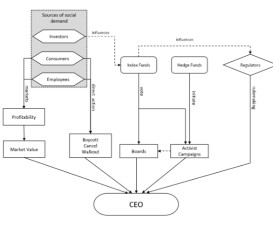

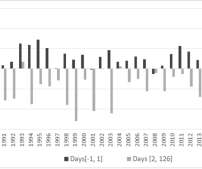

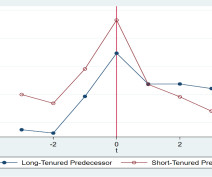

In a new article, we offer novel insights into the conundrum of ESG emphasis and present a conceptual framework for exploring the impacts on firm value of emphasizing both nonmaterial and material ESG factors. Over time, the negative impact of nonmaterial ESG emphasis on firm value becomes more pronounced.

Let's personalize your content