First Look at PvP Disclosure Trends From the 2023 Proxy Season

Harvard Corporate Governance

JUNE 7, 2023

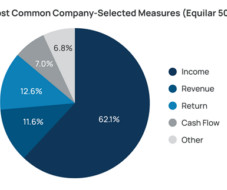

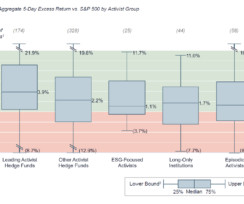

on Wednesday, June 7, 2023 Editor's Note: Amit Batish is Senior Director of Content at Equilar, Inc. The 2023 proxy season has officially come to a close. Separately, companies are also required to disclose their total shareholder return (TSR) and the TSR of their peer group. Posted by Amit Batish, Equilar, Inc.,

Let's personalize your content