Total Shareholder Return: What Is It And Why Does It Matter?

Quantive

MARCH 1, 2022

Business owners raise funds by inviting venture capital and private equity investments. […]

Quantive

MARCH 1, 2022

Business owners raise funds by inviting venture capital and private equity investments. […]

Harvard Corporate Governance

AUGUST 1, 2023

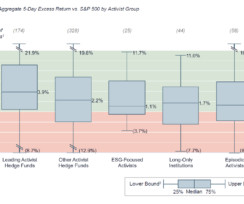

We measured total shareholder return (TSR) versus the S&P 500 over one week and one year as proxies for short term and long-term excess return generation. individuals, private equity funds, family offices). Our empirical review included campaigns waged between 2018 and H1 2023 at U.S. more…)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harvard Corporate Governance

JUNE 7, 2023

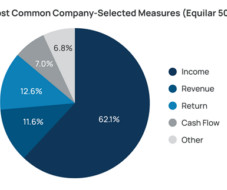

The goal of the CAP calculation is to capture the change in fair value of previously granted awards to named executive officers (NEOs), painting a clear picture of how much an executive has gained from equity awards over time. more…)

Harvard Corporate Governance

NOVEMBER 9, 2022

Compensation “actually paid” includes certain considerations for changes in pension value, above-market or preferential earnings on non-qualified deferred compensation, and changes in the value of equity awards throughout the year. the change in value of previously granted awards that vested during the year. Measuring the Performance Element.

M&A Leadership Council

AUGUST 1, 2023

Large public companies are generally expected to link their CEO pay to total shareholder return over one to three years, whereas a new start-up will tend to focus more on sales growth. Bonus pay may be hard to align following a merger between one firm with huge bonuses and another one with none. If so, what are they?

Reynolds Holding

DECEMBER 10, 2023

Part of the board’s responsibility is to ensure capital allocation decisions are made with a rationale founded in creating good long-term total shareholder returns. The board needs to manage the conflicts between the agents, the principals and indeed between the longer and shorter-term shareholders within the principals.

Benzinga

FEBRUARY 29, 2024

We are excited by the transformational opportunity offered by combining with First Advantage," said Adrian Jones, Global Chairman & Co-Head of the Private Equity business within Goldman Sachs Asset Management. Following the closing of the transaction, Scott Staples will continue to serve as Chief Executive Officer of First Advantage.

Let's personalize your content