Data Update 2 for 2022: US Stocks kept winning in 2021, but…

Musings on Markets

JANUARY 19, 2022

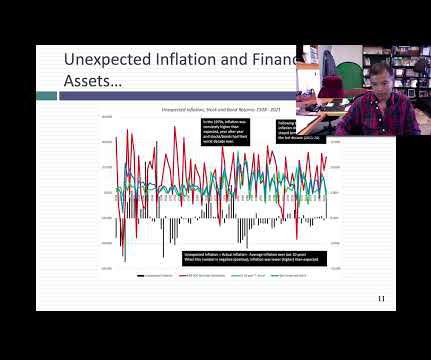

Leading into 2021, the big questions facing investors were about how quickly economies would recover from COVID, with the assumption that the virus would fade during the year, and the pressures that the resulting growth would put on inflation.

Let's personalize your content