After a strong 2021, European private banking faces headwinds

Mckinsey and Company

JULY 7, 2022

Western Europe’s private banks posted near-record profits last year, thanks to a high-performing market, but operational improvements stalled.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Mckinsey and Company

JULY 7, 2022

Western Europe’s private banks posted near-record profits last year, thanks to a high-performing market, but operational improvements stalled.

Harvard Corporate Governance

APRIL 12, 2023

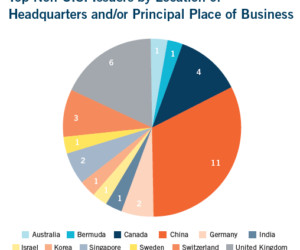

1] As was the case in 2021 and 2020, the Second Circuit continues to be the jurisdiction of choice for plaintiffs bringing securities claims against non-U.S. Continuing the trends in 2021 and 2020, most non-U.S. Liu, Christopher J. Merken , Andrew Stahl, and Austen Boer. The Third (3), Ninth (2), and Fourth (1) Circuits followed.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harvard Corporate Governance

MAY 11, 2023

News of colossal bank failures have threatened economic stability once again. In March 2023, Silicon Valley Bank (“SVB”) failed after a myriad of factors facilitated a large-scale bank run of its underlying deposits. This post is based on her recent paper , forthcoming in the Northwestern University Law Review. more…)

Harvard Corporate Governance

NOVEMBER 2, 2022

After the Great Financial Crisis triggered tightening of banking regulation, corporate lending has increasingly migrated out of the banking sector. Private debt funds raise capital commitments through closed-end funds (like private equity) and make senior loans (like banks) directly to, mostly, middle-market firms (i.e.

Harvard Corporate Governance

OCTOBER 7, 2022

For example, in pursuit of greater transparency on these issues, the first half of 2022 has already surpassed 2021 in terms of the number of shareholder proposals for race-related audits. Yet this pursuit of moving the needle towards the goal of achieving more positive results in the workplace on DEI has recently been met with resistance.

N Contracts

OCTOBER 4, 2023

The Justice Department (DOJ) continues to fulfill Attorney General Merrick Garland's 2021 promise that his department would “spare no resources” in upholding fair lending laws – this time with a $9 million redlining settlement with a $7 billion-asset Rhode Island bank.

Harvard Corporate Governance

NOVEMBER 8, 2022

Posted by Amma Anaman, Helle Bank Jørgensen, and Chantal Wessels, Nasdaq, Inc., on Tuesday, November 8, 2022 Editor's Note: Amma Anaman is Associate General Counsel and Legal Relationship Manager, Helle Bank Jørgensen is CEO of Competent Boards, and Chantal Wessels is Vice President, Head of Global Reporting and Corporate ESG at Nasdaq, Inc.

Brian DeChesare

NOVEMBER 22, 2023

I never expected to revisit the topic of bulge bracket banks so quickly because the full list changes slowly, and we updated it a few years ago. What is a “Bulge Bracket Bank”? The name “bulge bracket” (BB) comes from the prospectus for an IPO or debt issuance, which lists all the banks underwriting the deal.

Brian DeChesare

MARCH 13, 2023

In 24 hours, it went from “We’re fine, but we took some losses and need additional capital” to “The FDIC is taking over, the government has guaranteed uninsured deposits, and there might be additional bank runs and a financial crisis or three.” It’s the second-biggest bank failure in U.S. Silicon Valley Bank did not “fail” in 24 hours.

Musings on Markets

MAY 5, 2023

In March 2023, the fall of Silicon Valley Bank shocked investors not only because it was unforeseen, but also because of the speed with which it unfolded. That failure has had a domino effect, with Signature Bank falling soon after, followed by Credit Suisse in April 2023 and by First Republic last week.

Harvard Corporate Governance

AUGUST 14, 2024

For example, the Taskforce on Nature-related Financial Disclosures (TNFD), modeled after the Taskforce on Climate-related Financial Disclosures (TCFD), was launched in 2021 and released its final disclosure recommendations in September 2023. However, the link between biodiversity and finance has received little attention by academics.

Fox Corporate Finance

MARCH 7, 2022

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Bank Monitor – Q4 2021”. FCF regularly engages in research on the banking sector based on available data from the most active and. The post FCF Bank Monitor – Q4 2021 published appeared first on FCF Fox Corporate Finance GmbH.

Fox Corporate Finance

DECEMBER 20, 2021

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Bank Monitor – Q3 2021”. FCF regularly engages in research on the banking sector based on available data from the most active and. The post FCF Bank Monitor – Q3 2021 published appeared first on FCF Fox Corporate Finance GmbH.

Harvard Corporate Governance

MAY 2, 2023

stock market in 2022 experienced increased volatility relative to 2021. 4] Silicon Valley Bank’s (“SVB”) recent collapse, along with troubles at several other prominent banks, has called into question the frequency of further interest rate increases, amid concerns of contagion spreading through the wider global banking industry. [5]

Global Finance

FEBRUARY 5, 2025

Several global financial institutionsincluding the World Bank, the International Monetary Fund (IMF), and the Asian Development Bankestimate that Indonesias economy will grow within the range of 5% to 5.1% By 2045, the World Bank expects 317 million people. On the banking side, the sheer number of unbanked is huge.

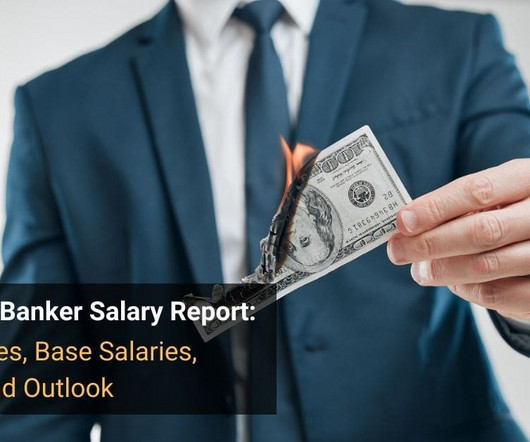

Brian DeChesare

FEBRUARY 2, 2022

I did not expect to revisit investment banker salary and bonus data for a while, but the banks ruined my plans by changing base salaries multiple times in less than a year. based roles at large banks as of early 2022, along with total compensation from 2021. Let’s say that a Year 1 Analyst in 2021 reported a bonus of $80K.

National Law Review M&A

MARCH 24, 2022

Sherrier Jurisdiction: All Federal Type of Law: Mergers & Acquisitions Financial Institutions & Banking Administrative & Regulatory

Brian DeChesare

JANUARY 11, 2023

The technology behind it is too complex to explain fully here, but it uses supervised/reinforcement learning and all the data on the Internet (as of 2021) to generate text based on statistical probabilities ( Wikipedia has a good summary ). This leads us to the possible impact on investment banking and other finance-related roles.

Harvard Corporate Governance

NOVEMBER 8, 2022

Hu is the Allan Shivers Chair in the Law of Banking and Finance at the University of Texas Law School. In 2021 and 2022, the Securities and Exchange Commission (SEC) voted out proposals directed at decoupling, as well as other proposals that may affect decoupling. Posted by Henry T.

Harvard Corporate Governance

JANUARY 9, 2023

Volatile global financial markets and recessionary fears have led to declining boardroom confidence and a decrease in deal activity from 2021’s record levels but are still healthy by historical standards. approached dealmaking with greater caution in 2022 than they did in 2021. Key Points. Acquisition market participants in the U.S.

Harvard Corporate Governance

AUGUST 17, 2022

Because of its relative simplicity and consistency, TCFD has garnered significant support from governments, central banks, and more than 2,600 organizations as of 2021, a 70% increase from 2020. 1] TCFD is a principles-based approach, developed with input from investors and companies. more…).

Harvard Corporate Governance

SEPTEMBER 3, 2022

Posted by Steve Lipin and Keilley Banks, Gladstone Place Partners, on Saturday, September 3, 2022 Editor's Note: Steve Lipin is founder and CEO and Keilley Banks is an analyst at Gladstone Place Partners. A 2021 survey by Charles Schwab found that 15% of all U.S. This post is based on their Gladstone Place memorandum.

Global Finance

AUGUST 1, 2024

Global Finance: How is digital banking changing Kuwait’s banking market? Among the most important developments introduced by the Central Bank of Kuwait are regulations to foster innovation in financial technologies and services. When we launched Msa3ed (Mosaed), we were the first bank in Kuwait with a digital assistant.

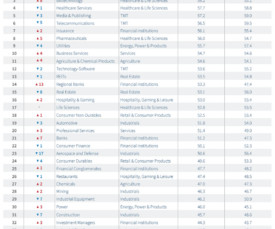

Viking Mergers

MAY 3, 2022

Nearly every industry had record activity in 2021, though. Even with 2021’s widespread increase in activity across industries, the technology sector continued to dominate, setting records for volume and value. The second-largest sector by value and by volume in 2021 M&A activity was industrials and chemicals. Technology.

Harvard Corporate Governance

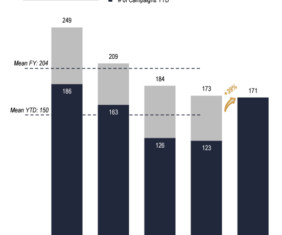

OCTOBER 19, 2022

Total campaigns YTD (171) up 39% over the same period last year, already approaching the total for full-year 2021 (173). North American targets accounted for two-thirds of all new campaigns in Q3, above H1 (55%) and 2018 – 2021 average (59%) levels. Continued Robust Activity Fueled by Strong Q3. Q3 activity in the U.S. (28 Recent U.S.

The Guardian M&A

AUGUST 26, 2023

The brothers from Blackburn were set on leapfrogging slightly bigger rival Sainsbury’s to make Asda the UK’s second-largest supermarket group.

Global Finance

JULY 29, 2024

Will Fed rate cuts and geopolitics fuel more M&A deals by GCC banks? Banks in the six-member Gulf Cooperation Council (GCC) are set to reap further gains as higher oil prices, increased public-sector spending, and red-hot real estate markets combine to generate a heady lending environment. surge in quarter-on-quarter profits.

Reynolds Holding

NOVEMBER 9, 2022

On October 19, 2022, 19 Republican state attorneys general (the AGs) launched a coordinated investigation by issuing civil investigative demands (CIDs) to six major US banks. The CIDs seek information related to the banks’ membership in the United Nations’ Net-Zero Banking Alliance (NZBA) and other climate-related initiatives.

Reynolds Holding

APRIL 13, 2023

The sudden collapse of Silicon Valley Bank (SVB) surprised many investors and industry experts, given the bank’s recent accolades and long-standing reputation as one of the best national and regional banks in the U.S. [1] 1] Moreover, there had been no reported bank failures during the COVID-19 pandemic from 2020 to 2022.

Law 360 M&A

JANUARY 11, 2024

Pittsburgh-based Dollar Bank FSB is facing a proposed class action in Pennsylvania state court that claims the bank failed to protect private information it inherited in a 2021 merger with Standard AVB Financial Corp., then waited months to inform customers whose data was compromised.

IVSC

SEPTEMBER 30, 2022

He is the Chairman of the boards of Stanbic Uganda Holdings Limited (part of Standard Bank Group of South Africa) and Uganda Breweries Ltd (a subsidiary of East African Breweries Plc, part of Diageo Group).

Reynolds Holding

OCTOBER 19, 2023

Given the widespread notoriety of meme stocks like AMC Entertainment, and Robinhood’s January 2021 halt of trading in GameStop shares, [1] this is not news to most people. Thus far, however, little has been written about the gamification of banking – the topic of our recent article. [3] Bank in 2022, “embedd[ing] U.S.

Global Finance

JUNE 17, 2024

A 10-year veteran at DBS Bank, Karoonyavanich recently expanded his role to cover all Equity Capital Markets business for the bank globally when the firm merged its equities, fixed income and brokerage businesses to form a new Investment Banking unit. in 2021 to an impressive 6.7% in the same period.

Global Finance

MAY 6, 2025

Building on a profitable and dynamic 2023, when high interest rates buoyed bank lending margins, most Western European banks had a strong 2024, ending the year with a spurt in net income and revenue growth. In addition, banks benefited from strong investor sentiment.

Global Finance

JUNE 6, 2024

That, in turn, is altering the competitive balance as traditional banks go head-to-head with financiers to provide CFOs with better terms and greater flexibility for managing working capital. A leading provider is Leverest FinTech, which launched its financing platform in 2021. The whole investment banking space is still not digitized.

Chris Mercer

MAY 19, 2023

This post was originally written for Mercer Capital’s Family Business Director Blog and offered advice to family business directors based on my observations following the failure of Silicon Valley Bank on March 10, 2023. This failure was followed by Signature Bank on March 12, 2023, and First Republic Bank on May 1, 2023.

Global Finance

MAY 6, 2025

The banking industry in Central and Eastern Europe (CEE) faced a particularly challenging 2024, marked by a highly fluid interest rate environment, macroeconomic uncertainty, and political volatility. The strongest banks in the region, though, were undeterred by macro difficulties. in the banking sectorwhile equity jumped by 70%.

Global Finance

JUNE 7, 2024

Goldman Sachs became the first Wall Street bank to comply with Saudi Arabia’s Regional Headquarters (RHQ) program and secure a license to establish its Middle Eastern base in Riyadh. Still, global banks are unlikely cede sole control of Saudi Arabia’s lucrative and relatively untapped market to Goldman Sachs for much longer.

Harvard Corporate Governance

SEPTEMBER 9, 2022

Posted by Steve Lipin and Keilley Banks, Gladstone Place Partners, on Saturday, September 3, 2022. BlackRock Voting Spotlight—A Look Into the 2021-2022 Proxy Voting Year. Getting Out the Retail Vote: Targeting Reddit and New Social Tools in Proxy Solicitations. Fisch (University of Pennsylvania), on Wednesday, September 7, 2022.

Machen McChesney

DECEMBER 6, 2022

In 2021, cryptocurrency markets reached all-time highs. Broader institutional adoption continued with the likes of BlackRock, Fidelity, JPMorgan Chase, Morgan Stanley, Deutsche Bank, and Goldman Sachs investing in the space and offering their clients crypto assets. What a difference a year makes.

Scott Mashuda

DECEMBER 20, 2021

Cleveland, OH — Scott Mashuda, founding partner of River’s Edge Alliance Group (REAG), received the Champions Award at the 2021 M&A Source Conference & Deal Market last month. Mashuda, who currently serves as conference chair for 2021, will continue serving on the board of directors as chair elect through 2022. .

Brian DeChesare

AUGUST 31, 2022

Traditionally, if someone asked the “ sales & trading vs. investment banking ” question, the response was easy: “Do banking unless you really, really like trading and could not imagine doing anything else.”. Investment Banking: 13%. What Makes Convertible Arbitrage Hedge Funds Different? Mixed IB / S&T Background: 6%.

Global Finance

JULY 25, 2024

The DoF recently held talks in Japan with Sumitomo Mitsui Banking Corporation and Nomura Securities as part of a roadshow to gauge interest from investors there. In 2018, the publicly held Japan Bank for International Cooperation acquired part of a multi-tranche ¥154.2 The government has tapped Japanese bond markets before.

Harvard Corporate Governance

JUNE 3, 2022

2021 Climate & Voting Review and Global Trends. Tags: Banker bonuses , Banks , Equity-based compensation , Executive Compensation , Financial institutions , Risk-taking , Stock options , Systemic risk. Posted by Subodh Mishra, Institutional Shareholder Services, Inc., on Saturday, May 28, 2022. Climate Stewardship.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content