Sovereign Ratings, Default Risk and Markets: The Moody's Downgrade Aftermath!

Musings on Markets

JUNE 2, 2025

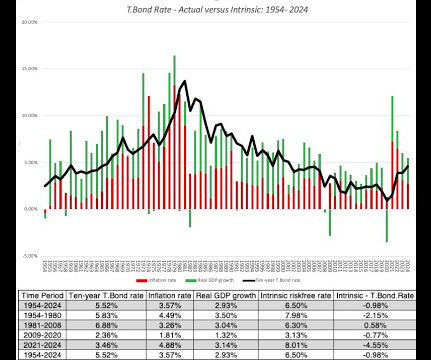

On the debt front, one of the measures that ratings agencies use to assess a country's financial standing is its debt to GDP ratio, and it is undeniable that this statistic has trended upwards for the United States: The ramping up of US debt since 2008 is reflected in total federal debt rising from 80% of GDP in 2008 to more than 120% in 2024.

Let's personalize your content