Shareholder Voting Trends (2018-2022)

Harvard Corporate Governance

NOVEMBER 5, 2022

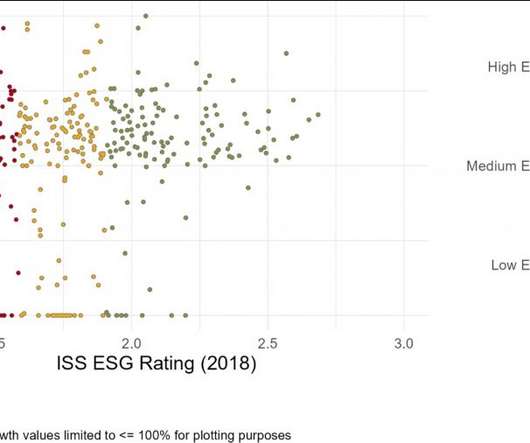

The success of many shareholder proposals on civil rights or racial equity audits. This commentary offers insights for what may lie ahead in the following areas: The continued increase in the number of shareholder proposals related to social and environmental policies of the company.

Let's personalize your content