Why Does Ebitda Get Adjusted?

Benchmark Report

SEPTEMBER 14, 2022

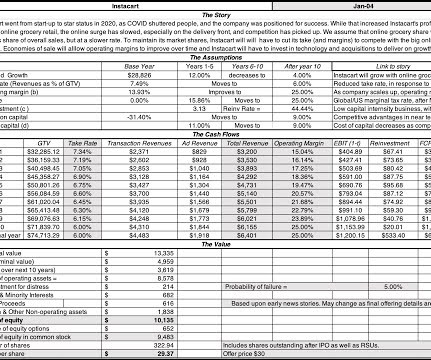

In the world of small to mid-market mergers and acquisitions, a number that is very important is a company’s adjusted EBITDA. The adjusted EBITDA is meant to find a company’s true normalized earnings by taking away any outside influences or ownership influences on the company’s bottom line.

Let's personalize your content