Still feeling good: The US wellness market continues to boom

Mckinsey and Company

SEPTEMBER 20, 2022

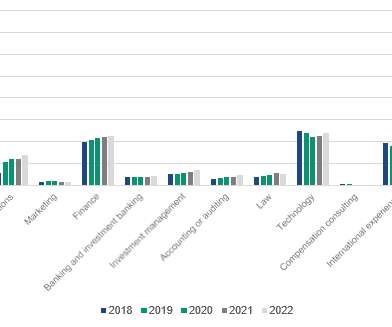

Our research shows continued growth of consumer interest in health and wellness, with persistent gaps in certain areas presenting exciting opportunities for companies to serve unmet consumer needs.

Let's personalize your content