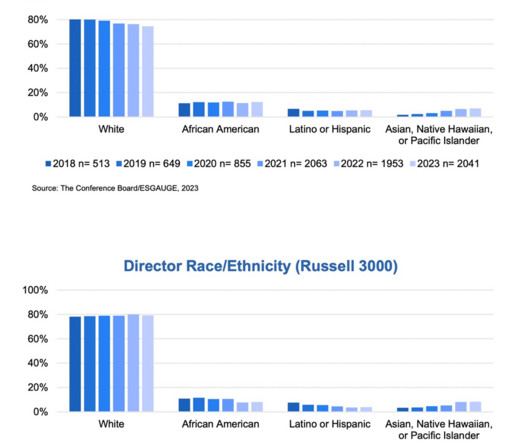

US Public Company Board Diversity in 2023: How Corporate Director Diversity Can Contribute to Board Effectiveness

Harvard Corporate Governance

NOVEMBER 24, 2023

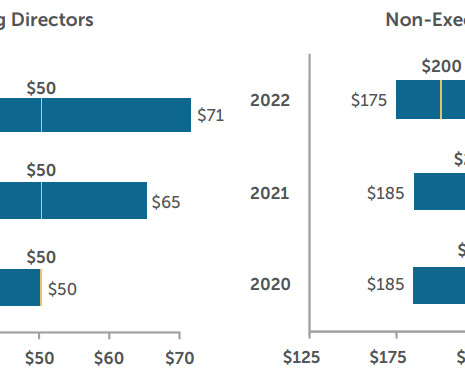

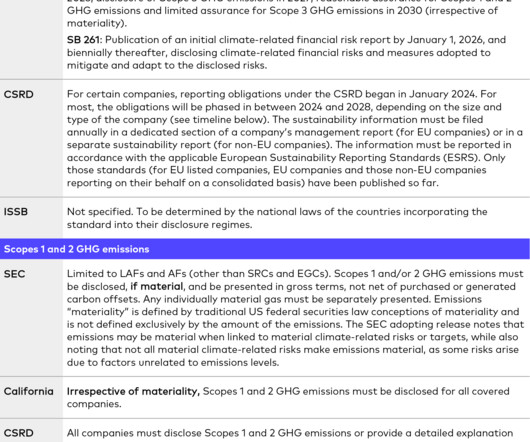

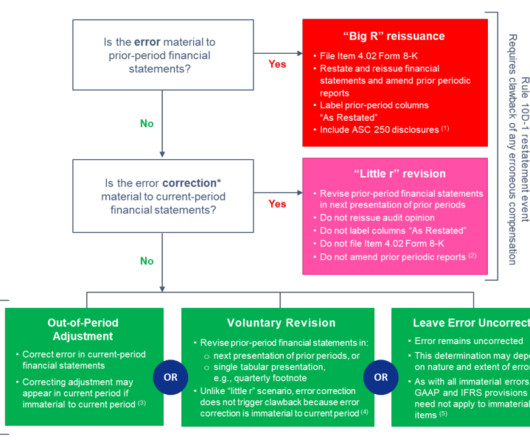

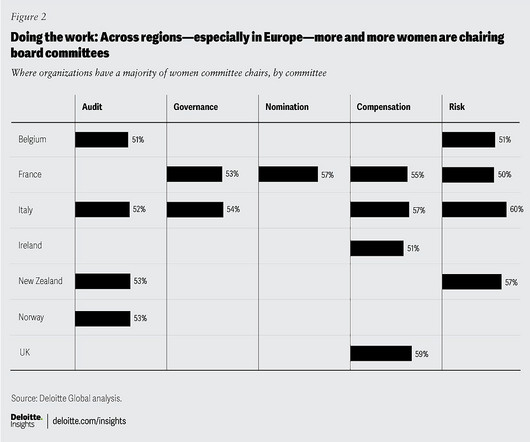

Normal 0 false false false false EN-US X-NONE X-NONE This report documents corporate governance trends and developments at US publicly traded companies—including information on board composition and diversity, the profile and skill sets of directors, and policies on their election, removal, and retirement.

Let's personalize your content