IVSC Webinars Series 2023 – Bios

IVSC

JUNE 12, 2023

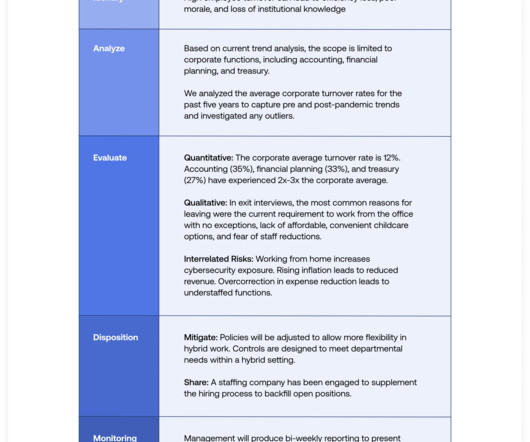

In her OPP role, she provides firm-wide technical guidance on a variety of valuation, financial reporting and tax issues. Carla has conducted numerous business and asset valuations for a variety of purposes, including purchase price allocations, goodwill impairment testing, M&A, corporate tax restructuring and debt analysis.

Let's personalize your content