Seeking Common Ground in the Politicized Debate About ESG

Harvard Corporate Governance

AUGUST 10, 2023

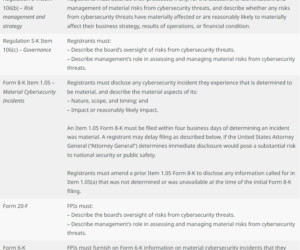

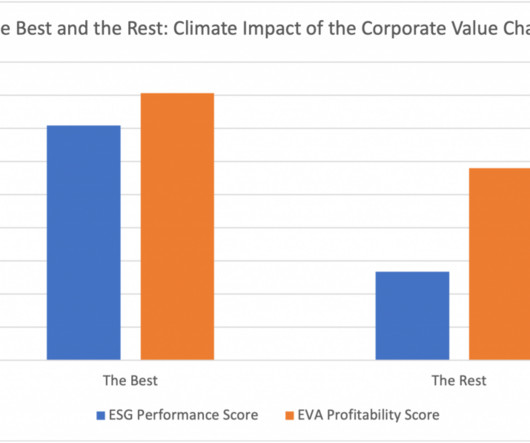

One of the topics at the center of the ESG debate is climate change. I argue that it has the authority to require disclosure of Scope 1 and 2 emissions but suggest that it not attempt to include universal disclosure of Scope 3 at this time. more…)

Let's personalize your content