What Do Shareholders Propose?

Harvard Corporate Governance

APRIL 16, 2024

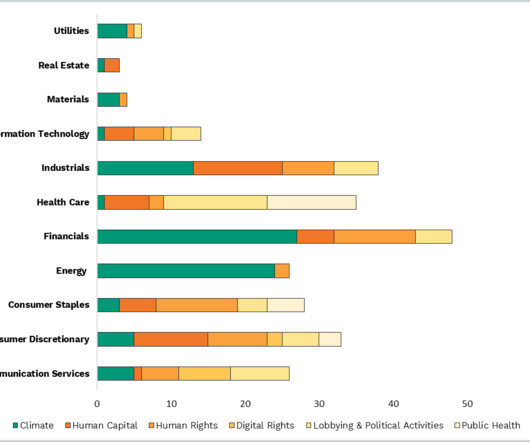

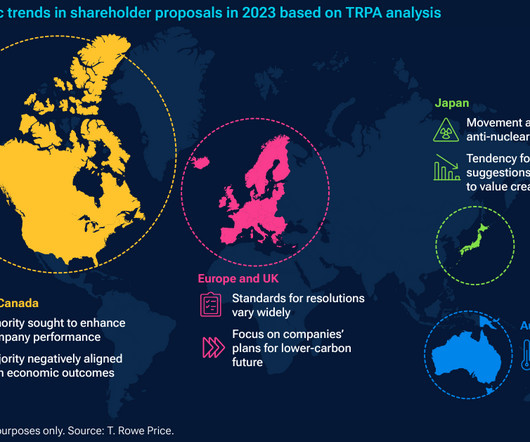

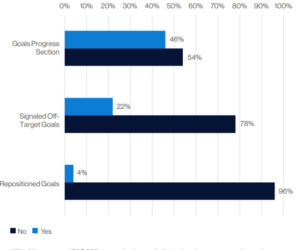

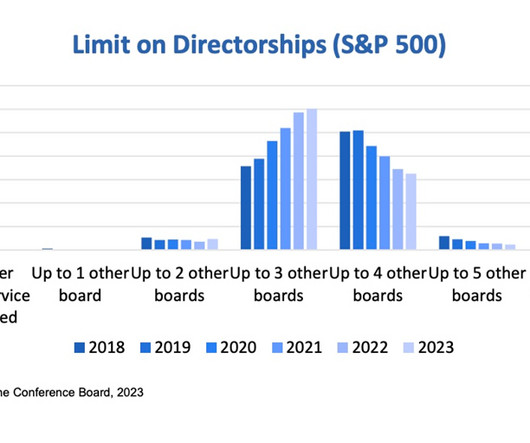

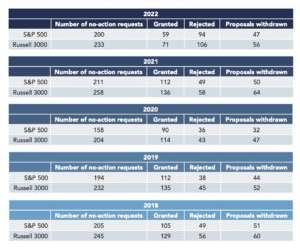

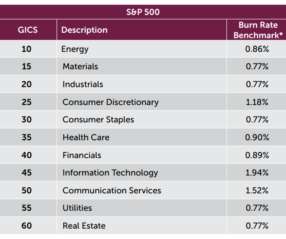

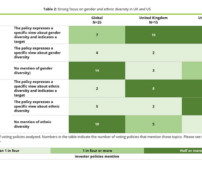

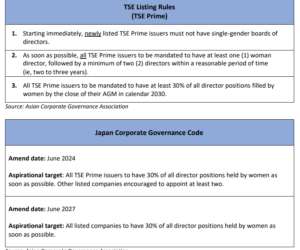

Introduction SquareWell published the inaugural edition of “ What do Shareholders Propose “, a comprehensive review of all shareholder proposals related to environmental, social, and governance (“ESG”) topics in Europe and the United States for 2022 and 2023, including the “Anti-ESG” movement. .”

Let's personalize your content