Regulatory Spotlight on Private Funds

Harvard Corporate Governance

NOVEMBER 19, 2023

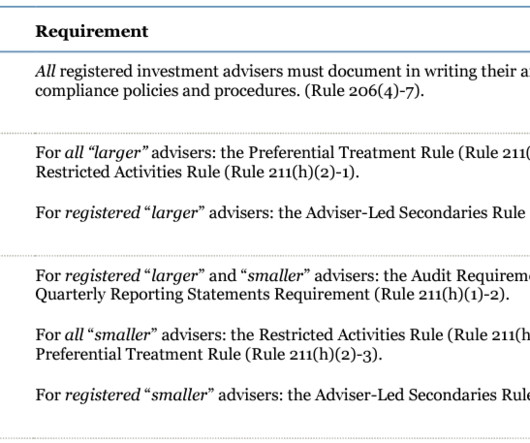

1] Focusing on private funds, Director Grewal stated earlier this year that private funds were a “substantive priority area” for the Division of Enforcement—and that has certainly been borne out in the 2023 docket. [2] more…)

Let's personalize your content