Maryland Raises Business Personal Property Tax Exemption

Gross Mendelsohn

AUGUST 18, 2022

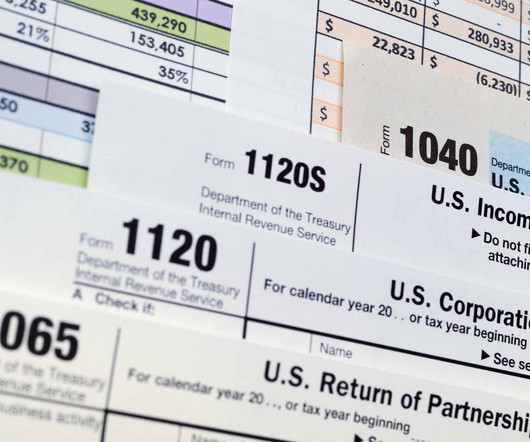

This legislation increases the exemption amount of personal property eligible to be taxed. As an extension of legislation HB90 , which exempts from personal property valuation and taxation if the total cost of the personal property was less than $2,500, this new legislation is said to save $44.2

Let's personalize your content