How Technology is Changing the Landscape of Mergers and Acquisitions

Sun Acquisitions

MARCH 20, 2024

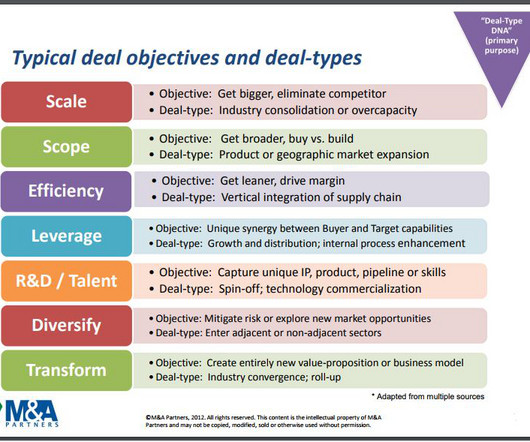

Mergers and acquisitions (M&A) have long been a fundamental strategy for businesses looking to expand, diversify, or gain a competitive edge. From due diligence to post-merger integration , technology has streamlined processes, improved decision-making, and enhanced the overall efficiency and success of M&A transactions.

Let's personalize your content