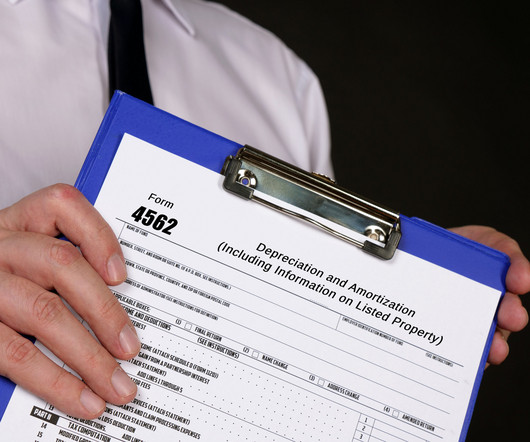

What to know about Form 4562: Depreciation and Amortization

ThomsonReuters

DECEMBER 1, 2023

Section 179 and expensing property Running a company is expensive. If, during the tax year, a client has purchased a tangible or intangible asset and is looking to claim depreciation and amortization deductions or expense certain property under Section 179 , Form 4562 must be filed with their annual tax return. What is Form 4562?

Let's personalize your content