Fee Variation in Private Equity

Harvard Corporate Governance

MAY 10, 2024

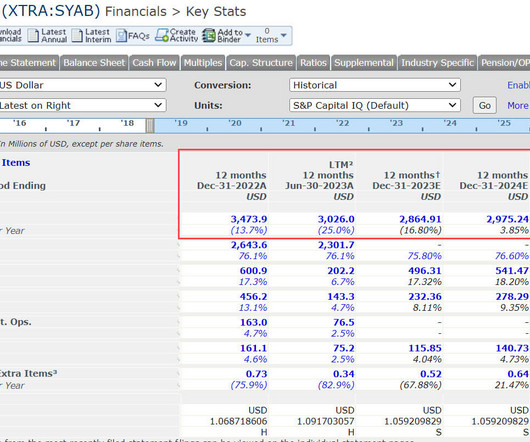

The private capital industry has experienced a meteoric rise over the past two decades, with estimates of capital invested in vehicles like private equity and venture capital now exceeding $10 trillion. Private capital funds, like private equity, are typically governed by complex limited partnership agreements (LPAs).

Let's personalize your content