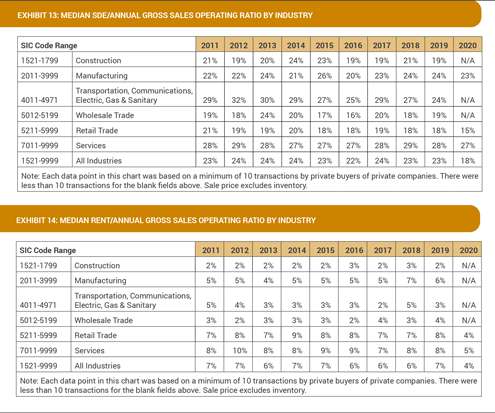

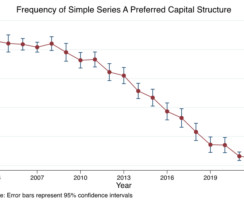

Get a Sneak Peek at Trends, Valuation Multiples, and Operation Ratios for Small, Main Street Private Companies

BVR

MARCH 28, 2022

BIZCOMPS, a comprehensive online database with financial details on small, Main Street private companies, has been recently updated with new transactions, and the current BIZCOMPS/BVR Deal Review (BDR), exclusively for subscribers, is now available.

Let's personalize your content