Platform, Evolved

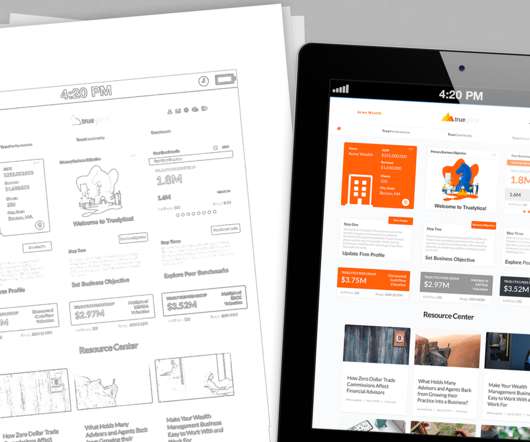

Truelytics

FEBRUARY 28, 2022

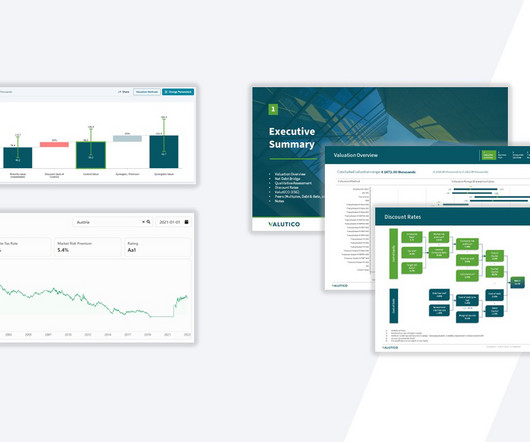

February development efforts are more technical and behind-the-scenes. So if you're not interested in knowing the technical details of what we're doing, you can skip this update. For everyone else still reading this sentence, let's go!

Let's personalize your content