Can We Trust the Accounting Discretion of Firms with Political Money Contributions? Evidence from U.S. IPOs

Harvard Corporate Governance

JULY 25, 2022

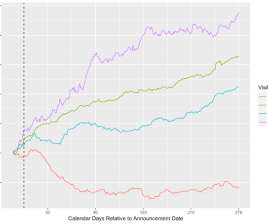

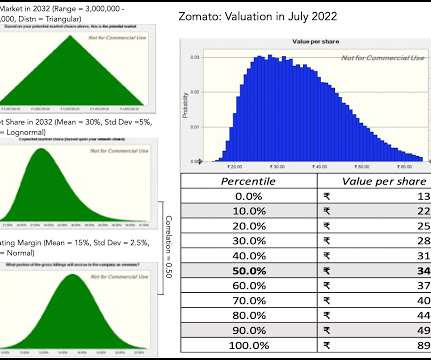

In our paper, Can we trust the accounting discretion of firms with political money contributions? IPOs , which was recently accepted for publication in the Journal of Accounting and Public Policy , we investigate the use of accounting discretion by initial public offering (IPO) firms with political money contributions (PMCs).

Let's personalize your content