IVSC Valuation Webinar Series 2024, Sponsored by Kroll

IVSC

APRIL 26, 2024

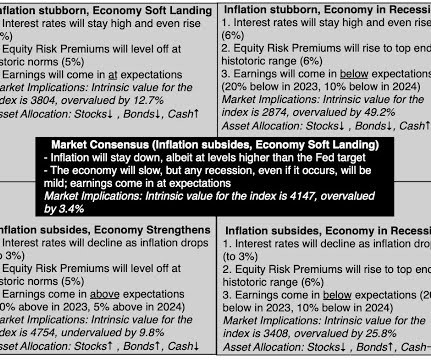

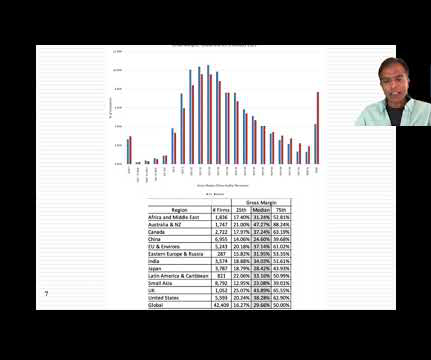

The sessions include: Global Trends Shaping Today’s Economy (13 June, 14:00 BST): This webinar explores key macroeconomic trends and their impact on business and investment, such as technology, climate change, and global finance, providing context for the upcoming valuation-focused discussions.

Let's personalize your content