A Follow up on Inflation: The Disparate Effects on Company Values!

Musings on Markets

MAY 20, 2022

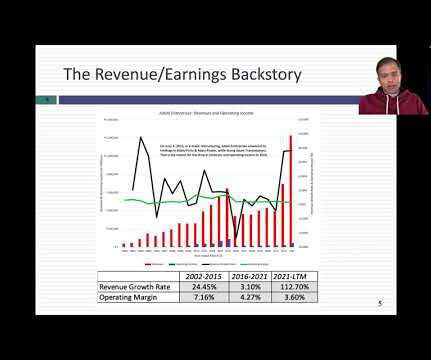

Historical Data: 1930-2019 To see how this framework works in practice, let's start by looking at the performance of US stocks, across the decades, and look at the returns on stocks, broadly categorized based on market capitalization and price to book ratios.

Let's personalize your content