Wachtell Lipton Discusses AI in the 2024 Proxy Season: Managing Investor and Regulatory Scrutiny

Reynolds Holding

MARCH 5, 2024

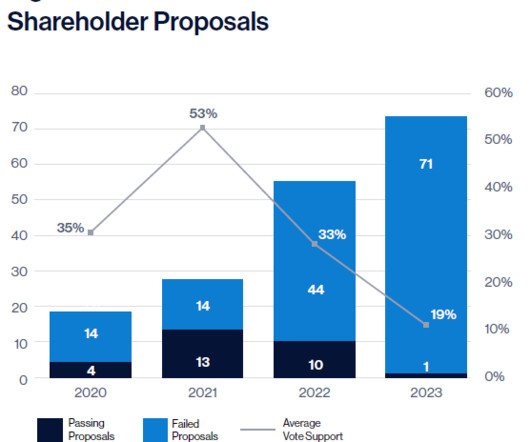

And some investors are clamoring for even more, using shareholder proposals to press public companies for detailed disclosures concerning AI initiatives, policies, and practices — including, most recently, an Apple shareholder proposal that attracted significant support at a meeting last week.

Let's personalize your content