Discount Rate—Explanation, Definition and Examples

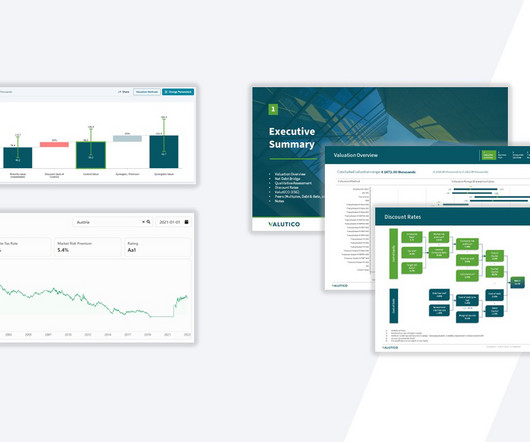

Valutico

FEBRUARY 27, 2024

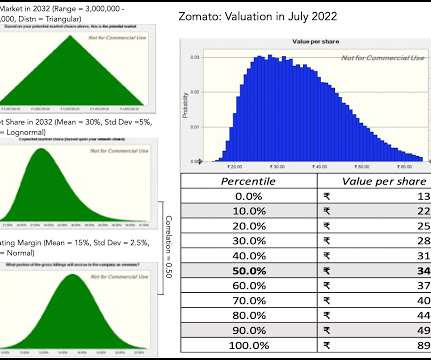

The discount rate effectively encapsulates the risk associated with an investment; riskier investments attract a higher discount rate. Different types of discount rates such as risk-free rate, cost of equity, or cost of debt, are used contextually in financial analysis. What is a discount rate?

Let's personalize your content