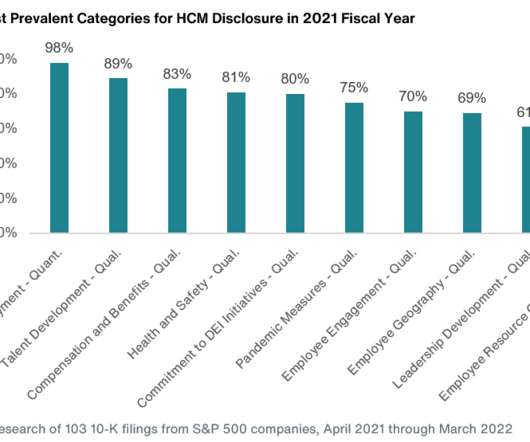

Key Themes of Human Capital Management Disclosure

Harvard Corporate Governance

MAY 16, 2022

Our research into the second year of required human capital management disclosure in companies’ Form 10-Ks finds a continued general lack of quantitative information. However, within the most prevalent topics for disclosure, we are observing more data being included, particularly when it comes to diversity, equity and inclusion.

Let's personalize your content