Board Reforms, Stock Liquidity, and Stock Market Development

Harvard Corporate Governance

AUGUST 29, 2022

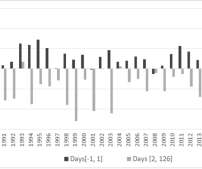

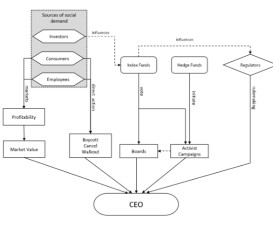

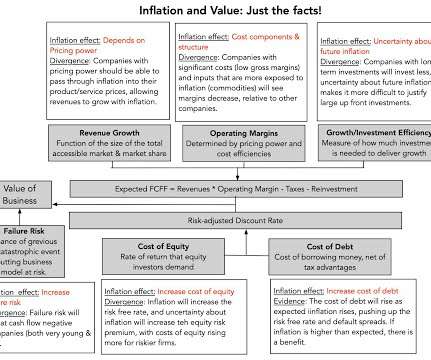

To develop financial markets, improve market liquidity and attract international capital, governments around the world are encouraged to improve their countries’ corporate governance systems and adopt internationally accepted best practices in corporate governance (e.g., OECD, 2011). OECD, 2011). Qiu and Slezak, 2019).

Let's personalize your content