The Price of Risk: With Equity Risk Premiums, Caveat Emptor!

Musings on Markets

AUGUST 5, 2023

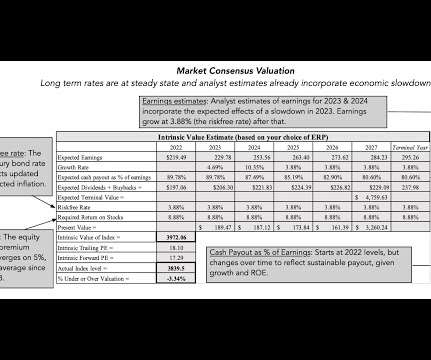

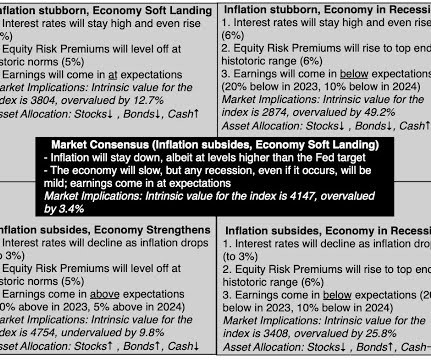

If you have been reading my posts, you know that I have an obsession with equity risk premiums, which I believe lie at the center of almost every substantive debate in markets and investing. That said, I don't blame you, if are confused not only about how I estimate this premium, but what it measures.

Let's personalize your content