Myths vs. Facts: What Do Private Equity Firms Do?

Viking Mergers

MAY 11, 2022

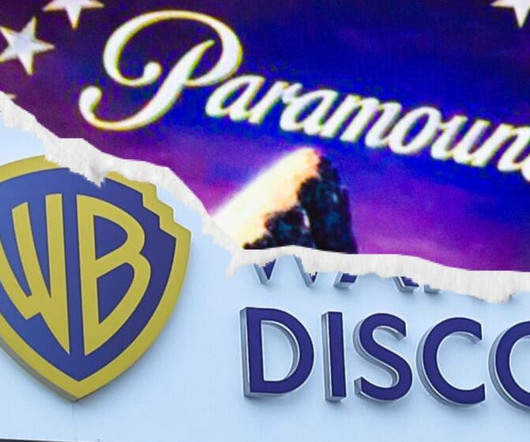

If you have ever looked into selling a business, you may have learned that there are many types of buyers and deal structures, from employee buyouts, strategic acquisitions, to private equity firms. We have noticed many misconceptions about a particular kind of buyer: the private equity firm.

Let's personalize your content