The Role of Intangible Assets in Startup Valuation

Equidam

JANUARY 9, 2024

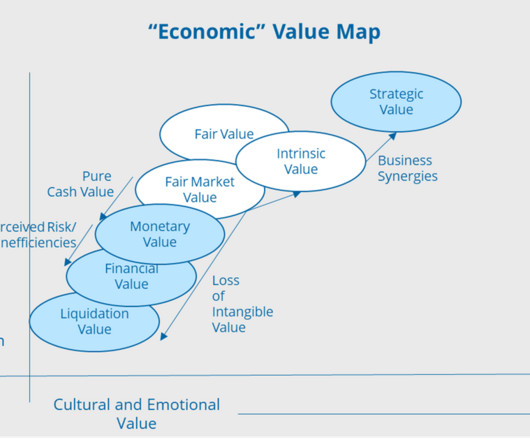

When analyzing the value of startups, the interplay of tangible and intangible assets becomes an important focus, especially from the standpoint of understanding the financial future of a business. In this article, we explore how these assets are not balance sheet items, but instead key indicators of potential and growth trajectory.

Let's personalize your content