Return on Equity, Earnings Yield and Market Efficiency: Back to Basics!

Musings on Markets

FEBRUARY 18, 2025

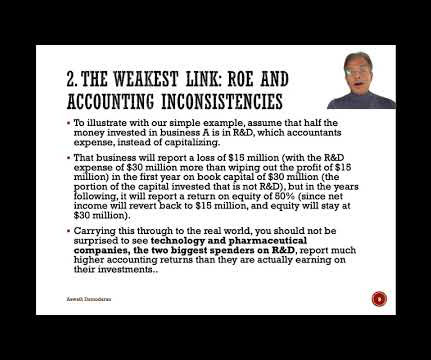

The first was the response that I received to my last data update , where I looked at the profitability of businesses, and specifically at how a comparison of accounting returns on equity (capital) to costs of equity (capital) can yield a measure of excess returns.

Let's personalize your content