Data Update 3: Inflation and its Ripple Effects!

Musings on Markets

JANUARY 27, 2022

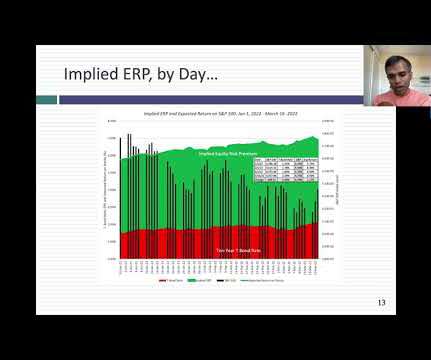

The treasury curve became steeper, but only at the shortest end of the spectrum, with the slope rising for the 2-year, relative to the 3-month, but not at all, when comparing the 10-year to the 2-year rate.

Let's personalize your content