Share schemes: how to get employee buy-in

Vested

OCTOBER 4, 2023

Employee buy-in is imperative to ensure that your company share scheme is a success. But your team will undoubtedly have questions. Here's how to prepare.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

employee-share-scheme

employee-share-scheme

Vested

OCTOBER 4, 2023

Employee buy-in is imperative to ensure that your company share scheme is a success. But your team will undoubtedly have questions. Here's how to prepare.

Vested

OCTOBER 25, 2022

In the UK, more SMEs than ever are implementing Enterprise Management Incentives (EMIs) and other tax-advantaged share and share option schemes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Vested

FEBRUARY 22, 2024

Well, you're in good company - over 14,000 UK-based businesses have launched an EMI scheme. An initiative of HMRC, EMI is designed to empower UK businesses, allowing them to offer share options to their employees in the most tax-efficient way possible. If you don't know what I'm talking about, I'll catch you up.

Vested

MAY 4, 2023

Sharing ownership to incentivise key team members is a winning strategy. Share schemes, like Enterprise Management Incentives , provide tax benefits while enabling startups to reward team members with equity.

Vested

FEBRUARY 20, 2023

More businesses are deciding to give their employees a slice of the action in the form of ownership – and we wholeheartedly support that movement! There are a few ways to offer ownership, including directly (via share schemes), indirectly (via trusts like Employee Ownership Trusts) and through co-operative ownership structures.

Vested

JANUARY 6, 2023

Share schemes equip businesses with a means to incentivise employees beyond capital alone.

Farrel Fritz

NOVEMBER 27, 2023

A special kind of breach of fiduciary duty, the corporate opportunity doctrine holds that “corporate fiduciaries and employees cannot. Initially, ROHM’s shares of stock were held by the Barbara Hurlbut Marital Trust (the “Marital Trust”), a trust Robert created in his will. In exchange, the nursing homes paid ROHM management fees.

RNC

JANUARY 12, 2023

Employee stock ownership plan (ESOP) is a type of retirement plan that provides employees with an ownership stake in the company they work for. ESOPs are often a valuable tool for startup businesses, as they can help to attract and retain talented employees and align the interests of employees with those of the company.

RNC

NOVEMBER 9, 2022

Organisations resort to many methods to hold back their employees in a time of crisis. They may be faced with employees leaving them. In an attempt to retain employees or as a general way of awarding deserving employees, organisations consider ESOP a valid option. It may be awarded to employees based on their performance.

Benzinga

NOVEMBER 22, 2023

Under the agreement, the newly established portfolio company will acquire all shares of Freeline not currently owned by Syncona for $6.50 per American Depositary Share (ADS). This price values Freeline's entire issued share capital at approximately $28.3 Freeline shareholders to receive $6.50

Reynolds Holding

DECEMBER 3, 2023

Currently, these broadly comprise: alterations to the target’s share capital, such as by issuing shares or granting options; acquisitions or disposals of assets of a material amount; and entry into contracts otherwise in the ordinary course of business. The amendments to the Code will take effect from December 11, 2023.

ThomsonReuters

MARCH 10, 2022

QUESTION: Our company is considering offering COVID-19 testing and vaccinations to employees at our offices. In general, an arrangement is an ERISA welfare benefit plan if it is a plan, fund, or program established or maintained by an employer to provide ERISA-listed benefits (including medical benefits) to employees.

Reynolds Holding

NOVEMBER 14, 2023

a global technology company, agreed to pay a $75 million civil penalty to resolve charges arising out of an alleged bribery scheme. In addition, the SEC obtained judgments from federal courts ordering: Danske Bank , a multinational financial services corporation, to pay a $178.6 Shaw & Co.,

Benzinga

FEBRUARY 22, 2023

NASDAQ: JNCE ) today announce an unanimously recommended Business Combination of the two companies via a proposed all share merger transaction. We are pleased that many of our employees will join the combined group and continue to focus on bringing much-needed alternatives to patients. Richard Murray, Ph.D.,

Reynolds Holding

JANUARY 16, 2023

The consultant then shared that information with two hedge fund clients, who made millions of dollars trading in securities of companies that would be affected by the rate changes before the rates were released to the public. Notably, no one else involved in the scheme paid the former colleague at CMS for the information.

Benzinga

APRIL 19, 2024

of the Irish Takeover Rules, that it is considering a possible offer (the "Possible Offer" ) to acquire all of the debt and the entire issued and to be issued share capital of MariaDB plc (" MariaDB "). for each MariaDB share, payable in cash. per share made by K1 Capital, announced on February 16, 2024; 88 per cent.

Benzinga

MAY 11, 2022

Diluted earnings per share was $0.24 in cash and 0.0552 of a share of MKS common stock for each Atotech common share (the "MKS Transaction"). The MKS Transaction is to be effected by means of a scheme of arrangement under Article 125 of the Companies (Jersey) Law 1991 (as amended).

ThomsonReuters

APRIL 18, 2023

Furthermore, Thomson Reuters research found that changes to tax rules is a major area of focus for employee training at firms in 2023, as 66 percent of firm leaders said they will offer such training to everyone in their firm. And these firms, many of them were horrified at the idea of their employees working remotely.

Reynolds Holding

JANUARY 9, 2023

Department of Justice formally charged Teva with three counts of conspiracy related to the alleged fraudulent scheme. Shareholders had alleged that Luckin engaged in a widespread fraudulent scheme to falsify more than $300 million in revenues. In 2020, the U.S. The complex U.S.

Reynolds Holding

OCTOBER 26, 2022

According to the DOJ and as set forth in court filings, Lafarge and its subsidiary schemed to pay ISIS and ANF in exchange for permission to operate a cement plant in Syria from 2013 to 2014, which enabled LCS to obtain approximately $70.3 As a result of the scheme, LCS obtained approximately $70.30 . §2339B. [1] million in revenue.

Reynolds Holding

SEPTEMBER 12, 2022

But this morning, I’d like to approach this theme somewhat differently, by sharing some thoughts on how we apply this lens to our own efforts. 1] The Securities and Exchange Commission disclaims responsibility for any private publication or statement of any SEC employee or Commissioner. ENDNOTES. [1] Navy Veterans and Sailors (Jul.

Reynolds Holding

NOVEMBER 1, 2023

That same week, the Federal Trade Commission announced an agreement with the Department of Labor to share information and partner on investigations, which underscores the U.S. The Division alleged that Allied, Foster, and Shell conspired with two unnamed asphalt paving companies and their employees to rig bids in each other’s favor.

Reynolds Holding

AUGUST 13, 2023

As to the first question, the Ripple court ruled that “XRP, as a digital token, is not in and of itself a ‘contract, transaction[,] or scheme’ that embodies the Howey requirements of an investment contract.” The company gave XRP to employees as it would give stock grants and options.

Reynolds Holding

OCTOBER 5, 2023

Some of the examples I’ll share today make this case: Invest in compliance now or your company may pay the price – a significant price – later. We are also keenly focused on the role compensation plays in guiding employee behavior. And we’re not done. sanctions. Again, we are seeing positive early returns.

Andrew Stolz

MAY 9, 2022

YouTube allows almost everyone to share and access useful information. In addition, this video show can adjust the look and feel using various themes, and you can even customize the dashboard to match the organization’s color scheme. Once you finish, you can share your dashboard easily for others to consume.

ThomsonReuters

NOVEMBER 4, 2020

This framework aims to put an end to tax avoidance strategies and mismatches in tax rules to ensure multinational enterprises pay their fair share of tax. When you have a system that tracks all guidance and houses data and reports in one place, you can easily deal with supplemental modifications, audits, and even employee turnover.

Audit Board

JULY 28, 2022

Richard Chambers: Cynthia, I recall it wasn’t long after the WorldCom story broke that you and a colleague came and sat down with Bill Bishop and me at The IIA, and we spent an afternoon allowing you guys to share the experiences you’d been through. I still remember those events like they were yesterday. Cynthia Cooper: I remember that.

Reynolds Holding

JULY 4, 2023

In all, the NPRM estimates that an HSR filing will be nearly four times more burdensome to file than under the current scheme, 3 though some media commentators have stated that the agency’s estimate of impact “in all likelihood, is a severe underestimation.” No similar requirement exists under the current rules.

Musings on Markets

NOVEMBER 15, 2022

I started by examining corporate governance , or its absence, and argued that some of the frustration that investors in Facebook feel about their views being ignored can be traced to a choice that they made early to give up the power to change management, by acquiescing to dual class shares.

Reynolds Holding

NOVEMBER 15, 2022

This is exemplified by the SEC’s actions against JP Morgan Securities LLC , 15 other broker dealers, and 1 investment adviser for widespread and longstanding failures to maintain and preserve work-related text message communications conducted on employees’ personal devices. In aggregate, the firms paid $1.235 billion in penalties.

Reynolds Holding

FEBRUARY 23, 2023

Today, I will share a snapshot of our 2022 enforcement results as well as our policy approach to white-collar and corporate crime. So, let me share some numbers. As its name suggests, this unit focuses upon schemes that not only victimize individual investors and taxpayers, but also undermine market integrity.

Reynolds Holding

JULY 17, 2023

293 (1946) as a seminal case construing “investment contract,” Quoting from Howey , the opinion interprets an investment contract as “a contract, transaction[,] or scheme whereby a person [(1)] invests his money [(2)] in a common enterprise and [(3)] is led to expect profits solely from the efforts of the promoter or a third party.” [4]

Reynolds Holding

OCTOBER 5, 2022

at 2594, the Court examined, among other things, Congress’s repeat rejection of an analogous scheme. Thus, in response to the lawsuit, the board issued one-third of the total outstanding shares “to reward and retain an essential employee” who had long been promised them. Next, the court considered Blasius.

Reynolds Holding

OCTOBER 12, 2022

It is critical for auditors to be alert to financial reporting areas that may be more frequently related to fraudulent schemes, such as improper revenue recognition and the intentional misstatement of accounting estimates. How are the survey results obtained and shared with leadership? 47] See PCAOB AS 2110.46-48.

Reynolds Holding

APRIL 3, 2024

And, together, we are better able to protect investors – which, after all, should be our shared mission. And as another example, just last month, the SEC charged 17 individuals for their role in an alleged crypto Ponzi scheme that raised $300 million from more than 40,000 investors, primarily from the Latino community. [14]

Reynolds Holding

JANUARY 3, 2024

On December 20, 2023, the UK Financial Conduct Authority (“FCA”) published a detailed consultation paper proposing major reforms to the UK listing regime with particularly significant implications for listings of equity shares in commercial companies. 10% of the issuer’s shares must be in public hands.

Reynolds Holding

NOVEMBER 9, 2023

With Scott’s legacy in mind, it would be appropriate to share some thoughts about the use of the Commission’s enforcement authority. 14] There was a time not too long ago when employees, for the most part, physically sat in offices and spoke to their co-workers in person. Supreme Court in a 1946 decision. [13] 13] In SEC v.

Reynolds Holding

APRIL 11, 2022

In light of the recent increased volatility in the global financial markets, 1 a number of companies have raised questions regarding the desirability of repurchasing shares at reduced market prices. What are the ways a company can repurchase its shares? structured programs, including accelerated share repurchase programs.

Reynolds Holding

MARCH 27, 2023

We continue to monitor the emergence of a potential circuit split regarding whether the Supreme Court’s 2019 decision in Lorenzo allows scheme liability under Rule 10b-5(a) and (c) without alleging dissemination and based solely on the same conduct as Rule 10b-5(b) misrepresentation claims. In particular, the Second Circuit in SEC v.

Reynolds Holding

FEBRUARY 14, 2023

The new rules require a written certification from directors and officers when adopting or modifying a 10b5-1 plan that he or she (a) is not aware of material nonpublic information about the company or its securities and (b) is adopting or modifying the plan in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b-5.

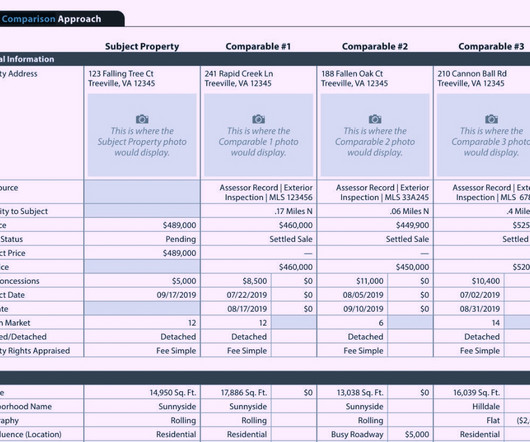

Appraisers Blog

MAY 3, 2023

No permission or signature sharing requests are necessary. link] Q32, MISMO scheme 3.6 Why would the appraisers employee status be considered an important new data inclusion? XML form type killed the protected signature argument. All one needs to do is extract that element from within the XML file, signature acquired.

Reynolds Holding

JULY 26, 2022

Robust compliance is a responsibility shared by all market participants. Despite the successes and priorities outlined above, the number of Enforcement employees has decreased over time. Robust Compliance. Finally, robust compliance is critical to restoring trust. We are in a time of rapid and profound technological change.

Farrel Fritz

NOVEMBER 7, 2022

RCF countered that the District Court had complete diversity jurisdiction because Cyrulnik no longer was a member of the firm and none of its remaining partners shared a domicile with Cyrulnik. Cyrulnik moved to dismiss the S.D.N.Y. District Judge John G.

Reynolds Holding

JULY 16, 2023

And the opportunity to assert and preserve constitutional claims against federal agencies has particular salience when considered against the backdrop of the Supreme Court’s recent decision, discussed further below, to hear argument next Term on the constitutionality of the SEC’s administrative adjudication scheme. In Groff v.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content