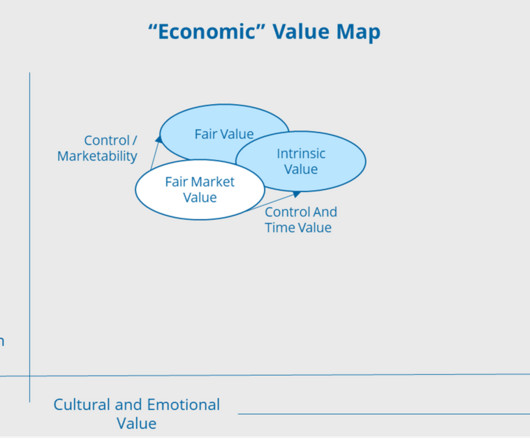

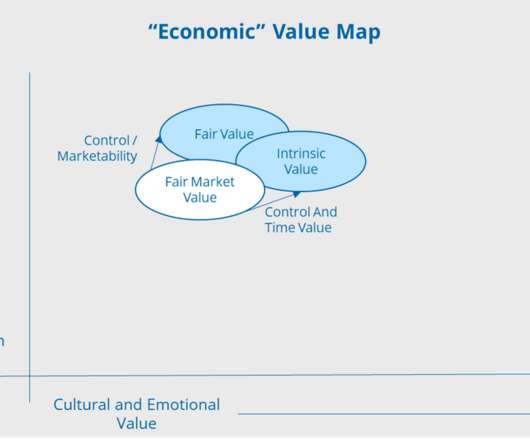

Transcending Value – Intrinsic and Fair Value

Value Scope

APRIL 16, 2021

Transcending Value – Intrinsic and Fair Value Blog 1 of 4: This is the first in a series of blogs that attempts to explain and distinguish between various valuation concepts, such as price, fair market value, fair value, liquidation value, intrinsic value, financial value versus strategic value, monetary versus economic value, emotional and psychic value, among others.

Let's personalize your content