A dealmaking denouement is under way for the decline of TV

Financial Times M&A

SEPTEMBER 21, 2023

After investing in streaming, media groups are looking to offload traditional broadcasting operations

Financial Times M&A

SEPTEMBER 21, 2023

After investing in streaming, media groups are looking to offload traditional broadcasting operations

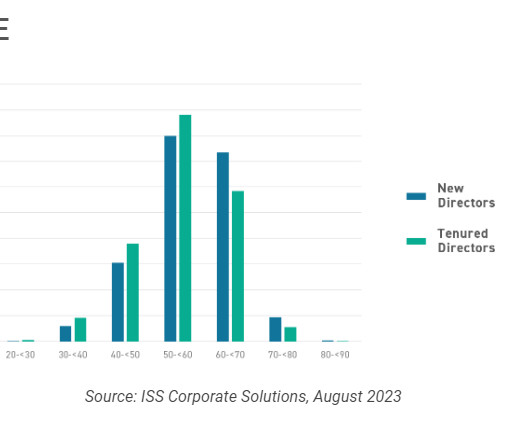

Harvard Corporate Governance

SEPTEMBER 22, 2023

Posted by Subodh Mishra, Institutional Shareholder Services, Inc., on Friday, September 22, 2023 Editor's Note: Subodh Mishra is Global Head of Communications at Institutional Shareholder Services (ISS) Inc. This post is based on an ISS Corporate Solutions memorandum by Sandra Herrera Lopez, Ph.D., Vice President, ESG Content & Data Analytics, & Veronica Nikitas, Senior Associate, Compensation & Governance Advisory at ISS Corporate Solutions.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

BVR

SEPTEMBER 22, 2023

BVResearch Pro is a great way to upgrade your BV research methodology on a broad range of BV topics from thought leaders in the business valuation and legal fields. However, with so much information at your fingertips, it can be overwhelming, so let's look at some ways to streamline your use of this amazing resource!

IVSC

SEPTEMBER 21, 2023

We are thrilled to be hosting this year’s International Valuation Standards Council (IVSC) Annual General Meeting (AGM) at Maison de la Chimie, situated in the heart of Paris, from 9-11 October. The IVSC AGM is a key annual event, uniting the IVSC’s boards, working groups, trustees, and member organisations from around the world. Over the course of the three-day program, participants will explore notable trends in valuation and examine the development of international standards.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

NYT M&A

SEPTEMBER 21, 2023

The federal agency claims the company’s practices amount to antitrust activity, a new salvo in the government’s scrutiny of health care consolidation that has led to higher prices.

Harvard Corporate Governance

SEPTEMBER 19, 2023

Posted by Richard J. Grossman, Neil P. Stronski and Demetrius A. Warrick, on Tuesday, September 19, 2023 Editor's Note: Demetrius A. Warrick , Richard J. Grossman , and Neil P. Stronski are Partners at Skadden, Arps, Slate, Meagher & Flom LLP. This post is based on their Skadden memorandum. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here ) by Lucian Bebchuk, Alon Brav, and Wei Jiang; Dancing wi

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Financial Times M&A

SEPTEMBER 17, 2023

Split between managers that can raise money and those that cannot will lead to consolidation, predicts Partners Group CEO

NYT M&A

SEPTEMBER 22, 2023

Britain’s antitrust regulator said the companies had addressed its main concerns about the $69 billion deal, though final approval is yet to come.

Harvard Corporate Governance

SEPTEMBER 17, 2023

Posted by Peter Pears, Tim Baines, and Oliver Williams, Mayer Brown LLP, on Sunday, September 17, 2023 Editor's Note: Peter Pears and Tim Baines are Partners and Oliver Williams is a Trainee Solicitor at Mayer Brown LLP. This post is based on a Mayer Brown memorandum by Mr. Pears, Mr. Baines, Mr. Williams, Patrick Scholl, James Taylor, Musonda Kapotwe.

Mckinsey and Company

SEPTEMBER 20, 2023

Leading indicators show signs of a rebound—will it sustain? Confidence potentially returning but consumers remain cautious; inflation persistent in some countries; trade volumes still declining.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Financial Times M&A

SEPTEMBER 20, 2023

Premier League club joins forces with US alternative asset manager as it looks for ways to boost revenue

NYT M&A

SEPTEMBER 22, 2023

The 92-year-old media tycoon is set to become chairman emeritus of Fox and News Corporation, but he still wields considerable power over the empire he built.

Harvard Corporate Governance

SEPTEMBER 18, 2023

Posted by Peter Molk (University of Florida), and and Adriana Robertson (University of Chicago), on Monday, September 18, 2023 Editor's Note: Peter Molk is the John H. and Mary Lou Dasburg Professor of Law at the University of Florida Levin College of Law and Adriana Z. Robertson is Donald N. Pritzker Professor of Business Law at the University of Chicago Law School.

Mckinsey and Company

SEPTEMBER 19, 2023

Many industry leaders expect significant disruption across the agriculture value chain over the next two years, resulting in new opportunities to build and scale green-growth, resilient businesses.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Appraisers Blog

SEPTEMBER 21, 2023

In reply to Raymond. When foreclosures was big in the market I had a contract with companies that managed the foreclosures. I did as many as 10 inspections in a day. so, it is very doable.

Law 360 M&A

SEPTEMBER 22, 2023

Nearly three decades after a "maggot" reference in a deposition prompted the Delaware Supreme Court to rebuke a lack of civility, a certain roughness is creeping back into the state's legal proceedings — and the Court of Chancery wants it to stop.

Harvard Corporate Governance

SEPTEMBER 20, 2023

Posted by Jason Booth, Will Arnot, and Miles Rogerson, Diligent Institute, on Wednesday, September 20, 2023 Editor's Note: Jason Booth is an Editorial Manager, Will Arnot is a Senior Editorial Specialist, and Miles Rogerson is a Financial Journalist at Diligent Market Intelligence. This post is based on a Diligent memorandum by Mr. Booth, Mr. Arnot, Mr.

Mckinsey and Company

SEPTEMBER 17, 2023

The 2023 McKinsey Global Payments Report shines a light on a changing industry and explains how banks and others can capitalize on new dynamics.

NYT M&A

SEPTEMBER 18, 2023

Casey Wasserman had long pledged to stay away from the traditional entertainment business, but he said a new media landscape changed his thinking.

Butcher Joseph & Co.

SEPTEMBER 17, 2023

Jeff Buettner helps untangle the complicated terrain of the current market shifts and explore how they impact valuations, deal structures, strategic b. The post Q3 2023 Quarterly Economic and M&A Middle Market Update appeared first on ButcherJoseph & Co.

Harvard Corporate Governance

SEPTEMBER 19, 2023

Posted by Matteo Tonello, The Conference Board, on Tuesday, September 19, 2023 Editor's Note: Matteo Tonello is Managing Director of ESG Research at The Conference Board, Inc., Jason D. Schloetzer is Associate Professor of Business Administration at the McDonough School of Business at Georgetown University, and Lyndon A. Taylor is a Partner at Heidrick & Struggle and the regional managing partner of the Americas CEO & Board of Directors Practice.

Mckinsey and Company

SEPTEMBER 19, 2023

AI is more accessible than ever. With a wealth of historical data and existing subject matter expertise, processing plants are well positioned to create new opportunities.

Financial Times M&A

SEPTEMBER 22, 2023

Competition watchdog was last big hurdle facing tech group’s attempt to buy ‘Call of Duty’ developer

Redpath

SEPTEMBER 19, 2023

As a business owner or manager, you have to accurately predict costs in order to set prices that enable your company to operate efficiently and turn a profit.

Harvard Corporate Governance

SEPTEMBER 21, 2023

Posted by Mark T. Uyeda, U.S. Securities and Exchange Commission, on Thursday, September 21, 2023 Editor's Note: Mark T. Uyeda is a Commissioner at the U.S. Securities and Exchange Commission. This post is based on his recent public statement. The views expressed in the post are those of Commissioner Uyeda, and do not necessarily reflect those of the Securities and Exchange Commission or the Staff.

Mckinsey and Company

SEPTEMBER 22, 2023

Asia will be the furnace in which a new era is forged—and may experience heightened versions of global challenges.

Financial Times M&A

SEPTEMBER 21, 2023

Complaint alleges New York-based firm consolidated market to become ‘dominant player’ for anaesthesia services in Texas

Gross Mendelsohn

SEPTEMBER 22, 2023

Payroll theft comes in all shapes and sizes and often lies hidden below the surface. Fraudsters who perpetrate ghost employee schemes use the shadow of another employee to cover their tracks. One of the best ways to prevent payroll theft is to understand what ghost employees are, and the motives behind their creation. Through a real-life case study, we look at how payroll fraud can be perpetrated, then offer strategies to uncover and prevent this kind of fraud.

Harvard Corporate Governance

SEPTEMBER 21, 2023

Posted by Gary Gensler, U.S. Securities and Exchange Commission, on Thursday, September 21, 2023 Editor's Note: Gary Gensler is Chair of the U.S. Securities and Exchange Commission. This post is based on his recent statement. The views expressed in this post are those of Chair Gensler, and do not necessarily reflect those of the Securities and Exchange Commission or its staff.

Mckinsey and Company

SEPTEMBER 22, 2023

Prompt engineering is the practice of designing inputs for generative AI tools that will produce optimal outputs.

Financial Times M&A

SEPTEMBER 21, 2023

The sector finds continuous ways to bypass the issue of true price discovery and keep their fee stream running

Machen McChesney

SEPTEMBER 19, 2023

Machen McChesney is committed to keeping you informed about critical developments that may impact your business. Today, we would like to bring to your attention an important update from the Internal Revenue Service (IRS) concerning the Employee Retention Credit (ERC) program.

Harvard Corporate Governance

SEPTEMBER 22, 2023

Posted by the Harvard Law School Forum on Corporate Governance, on Friday, September 22, 2023 Editor's Note: This roundup contains a collection of the posts published on the Forum during the week of September 15-21, 2023 Financial Implications of Rising Political Risk in the US Posted by Stephen Davis (Harvard Law School), on Friday, September 15, 2023 Tags: C+C , CEOs , Presidential elections , US institutions In 2022, Corporate Time Horizons Shorten, Investors’ Lengthen Posted by Allen He, Jes

Mckinsey and Company

SEPTEMBER 18, 2023

Global demand for fish and shellfish is growing rapidly—and alternative proteins are well positioned to sustainably scale the industry.

Let's personalize your content