Comcast and Disney Agree to Speed Up Hulu Deal

NYT M&A

SEPTEMBER 6, 2023

Disney is poised to own the entirety of the Hulu streaming service, which has more than 48 million total subscribers.

NYT M&A

SEPTEMBER 6, 2023

Disney is poised to own the entirety of the Hulu streaming service, which has more than 48 million total subscribers.

Harvard Corporate Governance

SEPTEMBER 2, 2023

Posted by Natalie Cooper (Deloitte LLP), Bob Lamm (Deloitte LLP), and Randi Van Morrison (Society for Corporate Governance), on Saturday, September 2, 2023 Editor's Note: Natalie Cooper is Senior Manager and Robert Lamm is an Independent Senior Advisor, at the Center for Board Effectiveness, Deloitte LLP; and Randi Val Morrison is Vice President, Reporting & Member Support at the Society for Corporate Governance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

BVR

SEPTEMBER 8, 2023

Vertical IQ is designed to help valuation practitioners like you get the most actionable industry intelligence for your valuation engagements. Let's take a look at some of the key reasons Vertical IQ can be an invaluable asset to your business.

Mckinsey and Company

SEPTEMBER 6, 2023

As customers increasingly expect seamless, engaging digital experiences, consumer-facing organizations can follow six principles to perform like the most successful tech companies.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Benzinga

SEPTEMBER 8, 2023

CBD of Denver, Inc. (OTC Pink: CBDD ) has closed the acquisition of HOLISTICH GmbH, a Swiss-based company with a location in Vienna, Austria with a focus on cannabis tissue cultures offering cannabis production facilities high-quality cannabis clones. What Happened HOLISTICH has an existing wholesale distribution and clone business that will immediately add revenues to Luxora.

Harvard Corporate Governance

SEPTEMBER 3, 2023

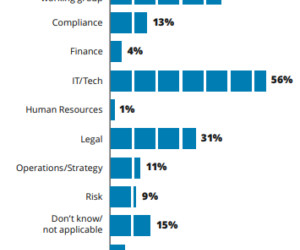

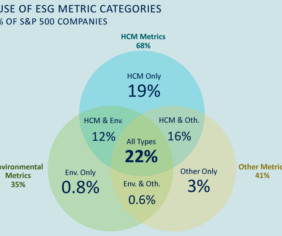

Posted by Matthew Mazzoni and Jennifer Teefey, Semler Brossy LLC, on Sunday, September 3, 2023 Editor's Note: Matthew Mazzoni is a Consultant and Jennifer Teefey is a Senior Associate Consultant at Semler Brossy LLC. This post is based on a report with data provided by ESGAUGE by Mr. Mazzoni, Ms. Teefey, Mira Yoo , Jay Veale , Cecilia Miao, and Anjani Trivedi.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Mckinsey and Company

SEPTEMBER 5, 2023

High long-term demand for recycled content in packaging could lead to shortages of recycled packaging materials. We explore three ways to boost rPET availability in the US market.

LaPorte

SEPTEMBER 8, 2023

The Society of Louisiana CPAs has named Jodie B. Arceneaux, CPA, as this year’s honoree of the Distinguished Public Service Award. Jodie is a tax… The post Jodie Arceneaux Receives LCPA’s Distinguished Public Service Award first appeared on LaPorte.

Harvard Corporate Governance

SEPTEMBER 7, 2023

Posted by Steven L. Schwarcz (Duke University), on Thursday, September 7, 2023 Editor's Note: Steven L. Schwarcz is the Stanley A. Star Distinguished Professor of Law & Business at Duke University School of Law and Senior Fellow of the Centre for International Governance Innovation. This post is based on his recent paper. Recent bank failures have spurred widespread demands to impose greater penalties on corporate managers that engage in excessive risk-taking.

Redpath

SEPTEMBER 7, 2023

Experienced business leaders know they need accurate information to make the best decisions for their company. Simply put, using a cash basis system for your bookkeeping and accounting leaves you lacking important information to measure your business by.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Mckinsey and Company

SEPTEMBER 4, 2023

The static UK energy retail market is starting to move as wholesale energy prices fall. As a third of customers look to switch suppliers, here’s how energy retailers can plug into customer needs.

Audit Board

SEPTEMBER 5, 2023

AuditBoard recently commissioned The Harris Poll to survey over 1,200 employed Americans on the use of AI-powered tools in the workplace compared to the presence of basic risk management controls. The results highlight interesting trends and potential concerns in AI adoption in the workplace. Regarding adoption, the survey found that about half of employed Americans (51%) use AI-powered tools (e.g., ChatGPT, DALL·E 2, Grammarly) for work, which can be viewed as a positive trend as employees seek

Harvard Corporate Governance

SEPTEMBER 6, 2023

Posted by Mei Cheng (University of Arizona) and Yuan Zhang (University of Texas at Dallas), on Wednesday, September 6, 2023 Editor's Note: Mei Cheng is an Associate Professor of Accounting at the University of Arizona and Yuan Zhang is an Associate Professor of Accounting at the University of Texas at Dallas. This post is based on their article forthcoming in the Review of Accounting Studies.

Law 360 M&A

SEPTEMBER 4, 2023

New cases in Delaware's Court of Chancery last week alleged "pie in the sky" investments by Palantir Technologies and wasteful satellite-launch contracts by Amazon. The nation's court of equity also logged notice of a $65 million settlement and got ready for another coming up this week that could be almost three times as much.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

N Contracts

SEPTEMBER 7, 2023

BRENTWOOD, Tenn., September 7, 2023 -- Ncontracts , the leading provider of integrated compliance, vendor, and risk management solutions to the financial industry, has been officially endorsed by the Georgia Bankers Association for its Risk Performance Management (RPM) Suite.

Financial Times M&A

SEPTEMBER 6, 2023

Europe’s biggest packaging company says it would cancel London listing and shift to US should deal complete

Harvard Corporate Governance

SEPTEMBER 7, 2023

Posted by Blair Jones (Semler Brossy), Anna Natapova (Semler Brossy), and Chuck Gray (Egon Zehnder), on Thursday, September 7, 2023 Editor's Note: Blair Jones is a Managing Director at Semler Brossy LLC, Anna Natapova is Principal at Semler Brossy LLC, and Chuck Gray is Coleader of the US CEO and Board Practice at Egon Zehnder. This post is based on a Semler Brossy memorandum by Ms.

Mckinsey and Company

SEPTEMBER 6, 2023

A leader on funding Europe’s energy transition talks about the three Ss that are necessary: speed, scale, and simplicity.

A Neumann & Associates

SEPTEMBER 7, 2023

Mergers and acquisitions ( M&A ) are complex transactions that require careful planning, analysis, and execution. Due diligence is a critical part of the M&A process, as it involves an in-depth examination of the target company’s financial, legal, operational, and other relevant information. Effective communication between the acquiring company and the target company is essential during the due diligence period to ensure a smooth and successful transaction.

Financial Times M&A

SEPTEMBER 4, 2023

‘Deals of the century’ were to be had for opportunists on both sides of the Atlantic

Harvard Corporate Governance

SEPTEMBER 8, 2023

Posted by Dalia Tsuk Mitchell (George Washington University), on Friday, September 8, 2023 Editor's Note: Dalia Tsuk Mitchell is The John Marshall Harlan Dean’s Research Professor of Law at George Washington University Law School. This post is based on her recent article published in the University of Chicago Business Law Review , and is part of the Delaware law series ; links to other posts in the series are available here.

Mckinsey and Company

SEPTEMBER 8, 2023

With the growth of e-mobility and younger consumers seeking high-tech convenience, nimble North American mobility-retail players are combining old and new offerings to stay competitive.

N Contracts

SEPTEMBER 8, 2023

Defining and measuring performance is necessary for financial institutions. To meet its strategic objectives, a bank or credit union must decide what it wants to achieve and evaluate its progress toward these goals.

Financial Times M&A

SEPTEMBER 2, 2023

Japanese entertainment powerhouse hopes India’s biggest TV broadcaster can help it repeat previous successes

Harvard Corporate Governance

SEPTEMBER 6, 2023

Posted by Ethan Klingsberg & Victor Ma, Freshfields Bruckhaus Deringer LLP, on Wednesday, September 6, 2023 Editor's Note: Ethan Klingsberg and Victor Ma are Associate at Freshfields Bruckhaus Deringer LLP. This post is based on their Freshfields memorandum, and is part of the Delaware law series ; links to other posts in the series are available here.

Mckinsey and Company

SEPTEMBER 5, 2023

Government remains one of the biggest productivity improvement opportunities. Organizations must be given both the ability and motivation to improve.

Accountancy Today

SEPTEMBER 7, 2023

FRP Corporate Finance has advised UK’s leading independent supplier of plastic pallets, Go Plastic Pallets, on its sale to Dutch based products and logistics services provider, Rotom Group. East Sussex-based Goplasticpallets.com is an independent supplier of plastic pallets, plastic pallet boxes and plastic containers. Founded in 2001, by co-founder’s Jim Hardisty and Chris Adam, the business is a team of experts who have over 160 years of experience within the logistics industry.

Financial Times M&A

SEPTEMBER 7, 2023

Tech giant has side-stepped some issues with deft concessions but faces scrutiny over its most important business

Harvard Corporate Governance

SEPTEMBER 5, 2023

Posted by Douglas K. Schnell and Daniyal Iqbal, Wilson Sonsini Goodrich & Rosati, on Tuesday, September 5, 2023 Editor's Note: Douglas K. Schnell is a Partner and Daniyal M. Iqbal is an Associate at Wilson Sonsini Goodrich & Rosati. This post is based on a WSGR memorandum by Mr. Schnell, Mr. Iqbal, Amy L. Simmerman , Ryan J. Greecher and Brad Sorrels.

Butcher Joseph & Co.

SEPTEMBER 4, 2023

ButcherJoseph & Co. Announced Finalists for Five M&A Deal of the Year Awards by The M&A Advisor for the 22nd Annual M&A Advisor Awards. The post ButcherJoseph & Co. Announced Finalists for Five M&A Deal of the Year Awards appeared first on ButcherJoseph & Co.

Mckinsey and Company

SEPTEMBER 8, 2023

Following five success factors can help create a winning strategy for embedding security into the new-product life cycle.

Financial Times M&A

SEPTEMBER 8, 2023

Abu Dhabi state energy group improves offer for German chemical company as emirate flexes financial muscle

Harvard Corporate Governance

SEPTEMBER 8, 2023

Posted by the Harvard Law School Forum on Corporate Governance, on Friday, September 8, 2023 Editor's Note: This roundup contains a collection of the posts published on the Forum during the week of September 1-September 8, 2023 Trends in Shareholder Proposals Posted by Nathan Williams, Jamie McGough, and Donald Kalfen, Meridian Compensation Partners, on Friday, September 1, 2023 Tags: director elections , Executive Compensation , Lobbying , Proxy season , Russell 3000 , S&P 500 , Shareholder

Machen McChesney

SEPTEMBER 6, 2023

From utilities and interest expense to executive salaries and insurance, many overhead costs have skyrocketed over the last few years. Some companies have responded by passing along the increases to customers through higher prices of goods and services. Is this strategy right for your business? Before implementing price increases, it’s important to understand how to allocate indirect costs to your products.

Let's personalize your content