Too Many Mergers? The Golden Parachute as a Driver of M&A Activity in the 21st Century

Harvard Corporate Governance

FEBRUARY 19, 2025

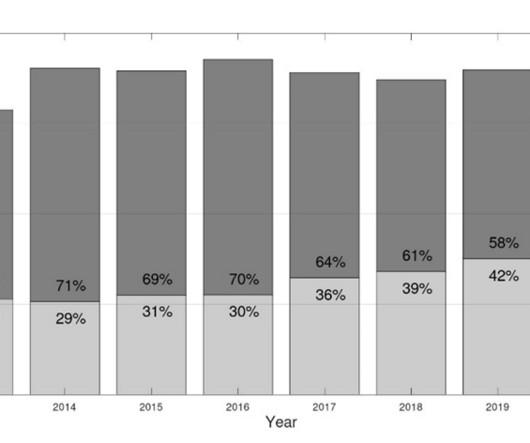

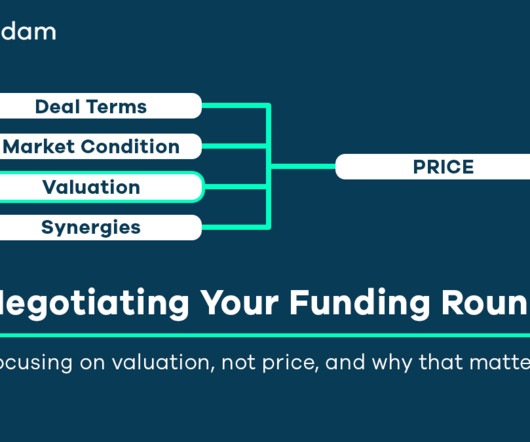

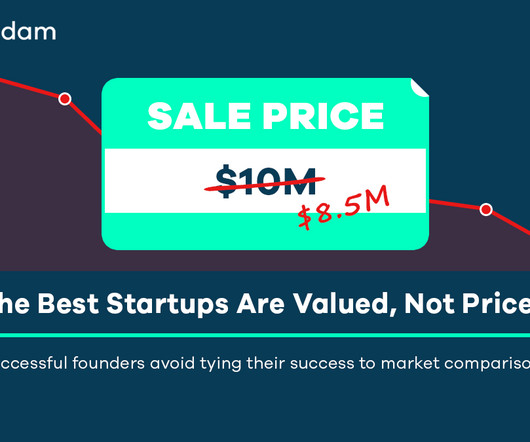

Posted by Jeffrey N. Gordon (Columbia Law School), on Wednesday, February 19, 2025 Editor's Note: Jeffrey N. Gordon is Richard Paul Richman Professor of Law at Columbia Law School. This post is based on his recent paper. This paper argues that the prevailing corporate governance regime in the United States has produced a level of mergers and acquisition activity that is higher than the social optimum because of a high-powered incentive for a CEO to exit through target-side M&A, the contempor

Let's personalize your content