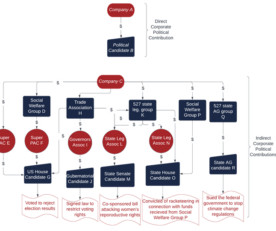

Looking Behind the Curtain: Corporate due diligence of political spending essential to protect companies from growing risks

Harvard Corporate Governance

APRIL 23, 2023

Posted by Jeanne Hanna, Bruce Freed and Karl Sandstrom, Center for Political Accountability, on Sunday, April 23, 2023 Editor's Note: Jeanne Hanna is Research Director, Bruce F. Freed is President and co-founder, and Karl J. Sandstrom is Strategic Advisor, at the Center for Political Accountability. Related research from the Program on Corporate Governance includes Corporate Political Speech: Who Decides?

Let's personalize your content