F.T.C. Sues to Block Kroger-Albertsons Grocery Store Deal

NYT M&A

FEBRUARY 26, 2024

The regulator is trying to stop the largest supermarket merger in history, arguing that the deal would eliminate competition and raise prices for consumers.

NYT M&A

FEBRUARY 26, 2024

The regulator is trying to stop the largest supermarket merger in history, arguing that the deal would eliminate competition and raise prices for consumers.

Harvard Corporate Governance

FEBRUARY 26, 2024

Posted by Elizabeth K. Bieber, Sarah Ghulamhussain, and Peter Liddle, Freshfields Bruckhaus Deringer LLP, on Monday, February 26, 2024 Editor's Note: Elizabeth K. Bieber and Sarah Ghulamhussain are Partners, and Peter Liddle is a Law Clerk at Freshfields Bruckhaus Deringer LLP. This post is based on their Freshfields memorandum. The two most influential proxy advisor firms, Institutional Shareholder Services (ISS) and Glass Lewis & Co.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Mckinsey and Company

FEBRUARY 26, 2024

Integrating AI into Canadian healthcare could help simplify administrative work; improve system management, care quality, and patient and staff experience; and boost affordability via lower spending.

Harvard Corporate Governance

FEBRUARY 26, 2024

Posted by Philip Larrieu, Oregon State Treasury, on Monday, February 26, 2024 Editor's Note: Philip Larrieu is a Stewardship Investment Officer at the Oregon State Treasury. This post was prepared for the Forum by Mr. Larrieu. Related research from the Program on Corporate Governance includes Universal Proxies (discussed on the Forum here ) by Scott Hirst and The Myth of the Shareholder Franchise (discussed on the Forum here ) by Lucian A.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Mckinsey and Company

FEBRUARY 26, 2024

Our latest Pulse survey of tech and telecommunications B2B decision makers reveals a generally optimistic investment outlook. But shifting market dynamics could turn different groups of vendors into new winners or losers.

BV Specialists

FEBRUARY 26, 2024

It seems not that long ago (although it was!) when running a small business or even working in a larger corporate environment involved a ton of phone calls, writing, typing, and mailing hard copies of letters and documents, while advertising in local trade journals or yellow pages. Over the past couple of decades, advances in technology have allowed companies to operate faster and much more effectively, providing additional opportunities to develop and grow a small business successfully.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Financial Times M&A

FEBRUARY 26, 2024

US’s biggest supermajor and China’s Cnooc highlight right of first refusal in Guyana project stake central to acquisition

Benzinga

FEBRUARY 26, 2024

Lower production among the world's largest nickel miners in response to a price slump for the metal end up supporting the market. That’s according to Russian metals giant Nornickel. London Metal Exchange nickel prices are down around 30% in the year through Friday, primarily driven by burgeoning supply from Indonesia — the world's largest producer of the metal.

Financial Times M&A

FEBRUARY 26, 2024

Move could test Beijing’s appetite to let Jack Ma-founded fintech expand after crackdown

Appraisers Blog

FEBRUARY 26, 2024

The damage caused by Appraisal Management Companies violating TILA & the Customary & Reasonable fee clauses goes beyond just financial losses.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

ThomsonReuters

FEBRUARY 26, 2024

There are many paths to accountancy, but this is one we don’t hear of often: Erin Heath grew up on a cattle ranch in South Dakota, where many of her “ranch-hand” duties sparked her interest in numbers. But it was an introduction to accounting class in high school that paved the way. “It was love at first sight,” she recalls. “I enjoyed it more than chasing cows.

Appraisers Blog

FEBRUARY 26, 2024

The response you received from the news director is the cut and pasted response everyone who wrote regarding this story received, including me.

Law 360 M&A

FEBRUARY 26, 2024

Simpson Thacher & Bartlett LLP-advised KKR said Monday it has agreed to acquire Broadcom Inc.'s end-user computing division in a transaction valued at approximately $4 billion, with Wachtell Lipton Rosen & Katz representing Broadcom on the deal.

Appraisers Blog

FEBRUARY 26, 2024

In reply to PD. Yes, you are so right. I did not touch of the other appraisals. If we are doing our jobs properly the spread at most in my opinion would be 3%-5% at most. The spreads are just too wide. So, he kept getting an appraisal until they hit the number. I wonder what he told the other two appraisers. This really stinks. I thank GOD I can pick what business I want.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

LaPorte

FEBRUARY 26, 2024

(authored by RSM US LLP) IRS urges employers to review ERC claims before the Voluntary Disclosure Program deadline of March 22, 2024. The agency warns of 7 common signs that their claims may be incorrect. The post The IRS urges businesses to review ERC claims for 7 common red flags first appeared on LaPorte.

Appraisers Blog

FEBRUARY 26, 2024

Nice read Russell and you are spot on. As you clearly pointed out this was a one sided presentation by the station and reporter that had a predetermined outcome. It is interesting that they interviewed and quoted only those who had a vested interest in the outcome of the opinion piece as though they are an authority on the appraisal process. The most important people who should have been interviewed were boots on the ground appraisers; but then again, that would not have fit their agenda.

Financial Times M&A

FEBRUARY 26, 2024

Stockholm-based buyout fund manager is predicting a revival of listings

Appraisers Blog

FEBRUARY 26, 2024

Irresponsible journalism is not reporting complete and accurate information. The media should accurately portray our profession.

Law 360 M&A

FEBRUARY 26, 2024

The Federal Trade Commission announced a new, national front Monday against Kroger's heavily-criticized $24.6 billion purchase of fellow grocery store giant Albertsons, challenging a deal it said threatens both shoppers and workers and cannot be saved by the planned divestiture of a "hodgepodge" of hundreds of stores.

Mckinsey and Company

FEBRUARY 26, 2024

The CEO of a cutting-edge fintech explain how his start-up offers investment services once reserved for the ultrawealthy to successful professionals.

Law 360 M&A

FEBRUARY 26, 2024

Delaware's Court of Chancery dropped two potentially far-reaching decisions last week: one about founder control at Moelis & Co. and another about TripAdvisor's planned move to Nevada. On top of that, there were new cases involving Citrix Systems, Alcoa Corp., BGC Partners Inc. and Cantor Fitzgerald LP.

Financial Times M&A

FEBRUARY 26, 2024

Plus, private equity takes advantage of the money pouring into credit and Sequoia’s internal drama

Reynolds Holding

FEBRUARY 26, 2024

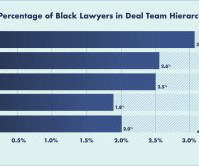

Business is a team sport, and the schools that teach it understand this: They generally orient their assignments, their grades, and their classes around collaboration. Law schools do basically none of these things. We train and assess law students as individuals: With few exceptions (e.g., moot court or journals), their classwork, their tests, and their job opportunities hinge on their ability to succeed as individuals.

Financial Times M&A

FEBRUARY 26, 2024

French shipping group CMA CGM increases offer for UK logistics group while third party considers bid

Benchmark Report

FEBRUARY 26, 2024

The seller, Robertson Lowstuter (R|L), is an industry-leading executive coaching firm renowned for its success in guiding executives to achieve peak performance by increasing their productivity, profitability, and effectiveness.

Farrel Fritz

FEBRUARY 26, 2024

In my business divorce practice I deal with many closely held corporations that have only a few or perhaps just two shareholders, each of whom is actively involved in running the business. Within that category are many companies whose owners essentially ignore some if not all the corporate formalities mandated by New York’s Business Corporation Law.

Benzinga

FEBRUARY 26, 2024

Alcoa Corp.(NYSE: AA ), a leading U.S. aluminum producer, has made a $2.2 billion offer to acquire Alumina Ltd (OTCQX: AWCMF ), its Alcoa World Alumina & Chemicals (AWAC) joint-venture partner. The offer comes at a volatile time for the commodities industry, with notable M&A activity. Per the all-stock deal , Alcoa is offering 0.02854 of its own stock for each Alumina share, representing a 13.1% premium over Alumina’s closing share price on Friday.

Mckinsey and Company

FEBRUARY 26, 2024

The energy transition continues apace. Meeting increasingly bold climate targets requires reducing capital expenditures while accelerating project timelines.

Law 360 M&A

FEBRUARY 26, 2024

A California federal judge refused Friday to end a proposed securities class action alleging Live Nation made misleading statements about its operations when news of alleged anticompetitive practices with Ticketmaster caused stock prices to drop, finding the suit describes "a materially different state of affairs" than what Live Nation claimed.

Benzinga

FEBRUARY 26, 2024

JetBlue Airways Corporation (NASDAQ: JBLU ) and Spirit Airlines Inc (NYSE: SAVE ) approached a U.S. appeals court with a plea on Monday to reverse a previous court decision that halted their proposed $3.8 billion merger. This appeal was made following a block by the U.S. Department of Justice, challenging the merger's legality and potential impact on market competition.

Law 360 M&A

FEBRUARY 26, 2024

A Texas bankruptcy judge declined to level sanctions against Latham & Watkins LLP and Jackson Walker LLP for trying to establish Texas jurisdiction for California-based Sorrento Therapeutics Inc. in its Chapter 11 bankruptcy, finding that their conduct did not amount to bankruptcy fraud.

Sun Acquisitions

FEBRUARY 26, 2024

Business photo created by rawpixel.com – www.freepik.com CHICAGO, IL – February 23, 2024 – A distinguished specialty plastics provider for medical devices out of Northern California, has initiated a sell-side engagement represented by Sun Acquisitions. With approximately 20 years of dedicated service, the client has established itself as a trusted partner in the medical device market.

Law 360 M&A

FEBRUARY 26, 2024

The Delaware Supreme Court on Monday refused to revive investors' $500 million challenge to Maxim Integrated Products Inc.'s $21 billion merger with Analog Devices Inc., leaving intact a Chancery Court decision throwing out the case in May.

Sun Acquisitions

FEBRUARY 26, 2024

In recent years, Sun Acquisitions, has observed rapid growth in the sign manufacturing industry though it’s M & A activity with sign manufacturing buyers and sellers. The sign manufacturing industry is witnessing a surge in minimalist design innovation. This trend is not just a fad but a strategic move for sign manufacturers to stay ahead of industry trends and reduce production costs.

Let's personalize your content