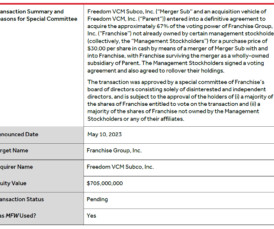

Special Committee Report

Harvard Corporate Governance

AUGUST 28, 2023

Posted by Gregory Gooding, Maeve O’Connor, and Caitlin Gibson, Debevoise & Plimpton LLP, on Monday, August 28, 2023 Editor's Note: Gregory V. Gooding and Maeve O’Connor are Partners and Caitlin Gibson is a Counsel at Debevoise & Plimpton LLP. This post is based on a Debevoise memorandum by Mr. Gooding, Ms. O’Connor, Ms. Gibson, Andrew Bab , Bill Regner , and Matthew Ryan , and is part of the Delaware law series ; links to other posts in the series are available here.

Let's personalize your content