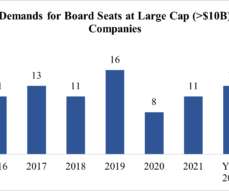

Shareholders’ Rights & Shareholder Activism Trends and Developments

Harvard Corporate Governance

OCTOBER 26, 2022

Posted by Eleazer Klein, Michael Swartz, Adriana Schwartz, Schulte Roth & Zabel LLP, on Wednesday, October 26, 2022 Editor's Note: Eleazer Klein , Michael Swartz , and Adriana Schwartz are Partners at Roth & Zabel LLP. This post is based on a piece by Mr. Klein, Mr. Swartz, Ms. Schwartz, and Brandon Gold. Trends and Developments. Shareholders’ Rights and Shareholder Activism in the USA.

Let's personalize your content