Good and Bad CEOs

Harvard Corporate Governance

OCTOBER 24, 2023

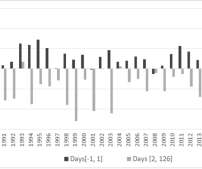

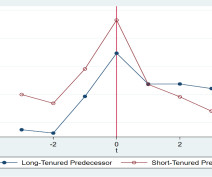

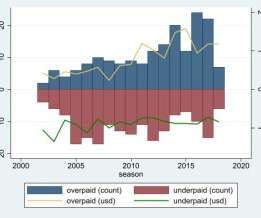

To make progress on this question, our paper “ Good and Bad CEOs ” analyzes changes in firm value, performance, and behavior caused by deaths of incumbent CEOs. Unlike other CEO turnovers, most CEO deaths are randomly allocated to firms and are not a decision made by the board of directors.

Let's personalize your content