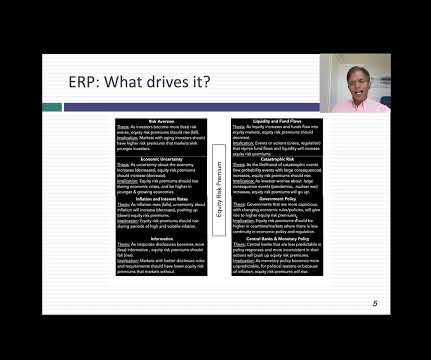

What Is Equity Risk Premium?

Andrew Stolz

AUGUST 4, 2020

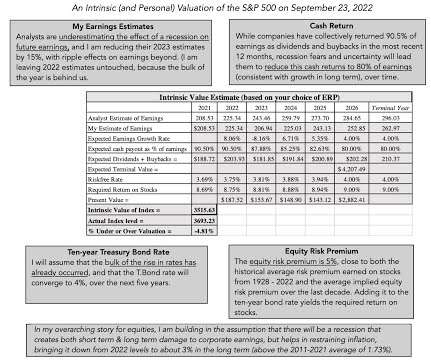

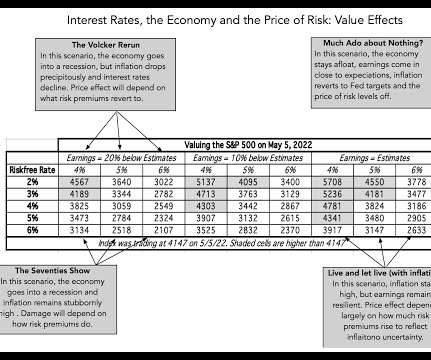

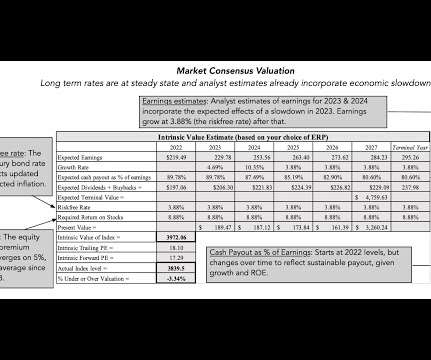

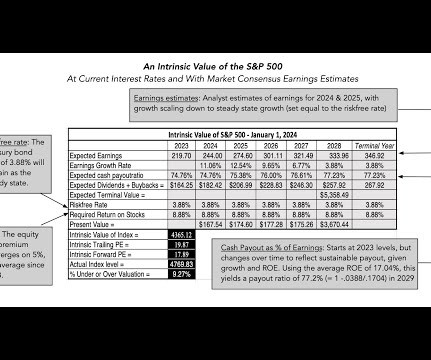

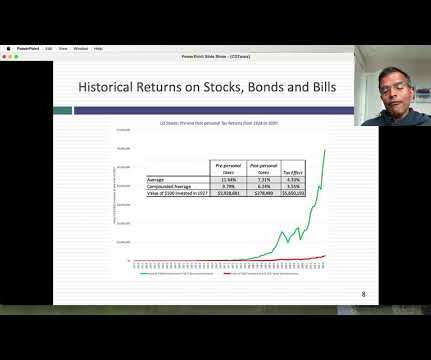

Definition of Equity Risk Premium. It is the difference between expected returns from the stock market and the expected returns from risk-free investments. What Impacts the Equity Risk Premium? Dividends . How Do You Calculate Equity Risk Premium? Dividend model ? Earnings model ?

Let's personalize your content