Is Radiant Opto-Electronics an Undervalued Dividend Play?

Andrew Stolz

FEBRUARY 7, 2022

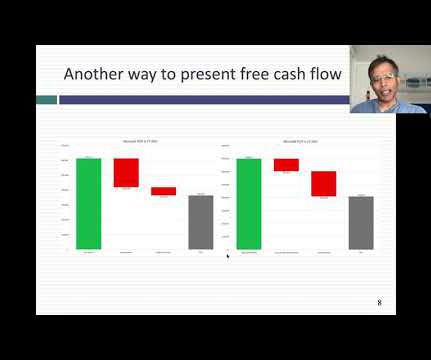

Highlights: End markets mature, no opportunities to grow. Massive dividend yield secured by strong cash generation. End markets mature, no opportunities to grow. ROEC’s revenue is mainly dependent on the growth of the end markets such as computers, phones, and tablets. The FCF yield shows ROEC’s dividend-paying potential.

Let's personalize your content