Will luxury brand LVMH continue to outpace the stock market?

Valutico

MARCH 9, 2023

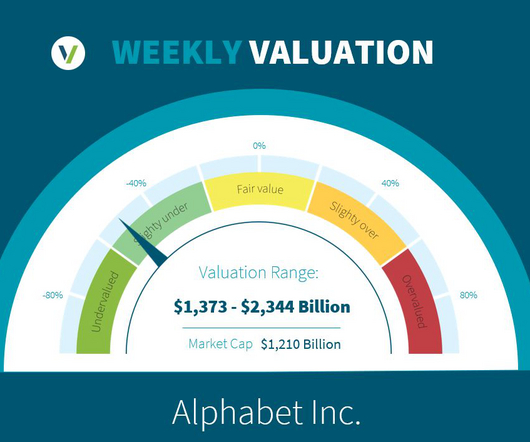

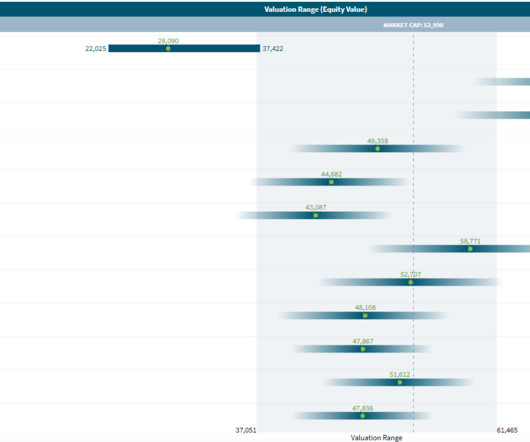

With a market capitalization of €395 billion, it is the most valuable company in Europe. The Discounted Cash Flow analysis produced a value of €330 billion using a WACC of 9.3%. In comparison to LVMH’s market capitalization of €395 billion we suggest that the company is fairly valued.

Let's personalize your content