What is central bank digital currency (CBDC)?

Mckinsey and Company

MARCH 1, 2023

CBDCs are digital currencies issued by central banks. Their value is linked to the issuing country’s official currency.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

currencies

currencies

Mckinsey and Company

MARCH 1, 2023

CBDCs are digital currencies issued by central banks. Their value is linked to the issuing country’s official currency.

Mckinsey and Company

OCTOBER 13, 2022

With central banks increasingly exploring central bank digital currencies (CBDCs), now is the time for commercial banks to establish their role in a fast-changing landscape.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Law 360 M&A

NOVEMBER 20, 2023

Digital assets exchange Bullish said Monday it has purchased cryptocurrency-focused media company CoinDesk from Digital Currency Group, appointing former Wall Street Journal Editor-in-Chief Matt Murray as chair of its editorial committee.

Equilest

JANUARY 26, 2023

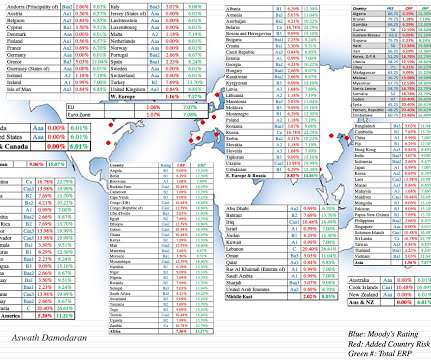

To dive deeper into the topic of Currency Risk and its impact on business valuation, check out our detailed article on the subject. He has a wealth of experience in assessing and evaluating companies, and has spent years studying the impact of currency risk on business valuation.

Musings on Markets

JANUARY 27, 2021

In this post, I will take a look at these other markets, starting with a way of dividing investments into assets, commodities, currencies and collectibles that I find useful in thinking about what I can (and cannot) do in those markets, and then reviewing how these markets performed during 2020. Currencies : A currency serves three functions.

Reynolds Holding

NOVEMBER 22, 2022

Department of the Treasury’s Office of Foreign Assets Control (OFAC) and the Financial Crimes Enforcement Network (FinCEN) announced settlements for approximately $24 million and $29 million, respectively, with virtual currency exchange Bittrex, Inc. AML and sanctions laws. Below is a summary of the key takeaways.

Harvard Corporate Governance

JANUARY 22, 2024

Specifically, similar idiosyncratic foreign currency shocks move the idiosyncratic stock returns of firms sensitive to those currencies 60% less when the firm is in the S&P 500 index than in proximate times when it is not in the index.

Law 360 M&A

APRIL 26, 2024

Recent proposals for bank merger review criteria by the Office of the Comptroller of the Currency and Federal Deposit Insurance Corp.

Appraisers Blog

JUNE 16, 2023

Placing an entire country in a usury debt based currency system. The federal reserve seeks to devalue your currency 2%, year over year over year. A private corporation whom creates money out of thin air, backed by nothing. The last jubilee was a mere decade ago, rolling around again soon. You and I will not be the beneficiaries.

Financial Times M&A

OCTOBER 12, 2022

Ares Management’s Blair Jacobson expects US buyers to take advantage of weak British currency

Global Finance

AUGUST 31, 2023

Unlike are forms of cryptocurrency, stablecoins are typically backed by an asset or a basket of assets like gold or a traditional fiat currencies like the U.S. dollar or Euro.

Mckinsey and Company

DECEMBER 15, 2022

Central bank digital currencies and stablecoins could reshape financial services. Treasury managers can play a central role in optimizing the related opportunities—and handling of the risks.

Law 360 M&A

FEBRUARY 10, 2023

The Office of the Comptroller of the Currency's top lawyer on Friday called for regulators to "build a better mousetrap" for reviewing bank merger transactions, saying there's a greater chance that harmful mergers will get approved if the current review framework isn't updated.

Appraisers Blog

JANUARY 17, 2024

I was looking at currency conversion and affordability indexes, they’re everyday workers at those wages, but in India. There is the factor of risk though, because there are a lot of corrupt industries in India, but they’re not all that way. They’re in another country and can run the benefit of scale. They seem nice enough.

Global Finance

JUNE 4, 2023

North American industries most affected by currency exposure were professional services, biotech and pharmaceuticals, machinery, trading and distribution, chemicals and health equipment and supplies.

The Guardian M&A

SEPTEMBER 27, 2022

The currency has fallen by more than a fifth against the dollar this year. A fresh frenzy of merger and acquisition activity would mean a ramp-up in payouts for City dealmakers. Sterling fell by nearly 5% at one point on Monday to $1.0327, its lowest since Britain went decimal in 1971. Continue reading.

Harvard Corporate Governance

OCTOBER 24, 2022

and Europe, where weak currencies have cut into earnings forecasts. Demands for cost-cutting and debt reduction are on the rise, as well as greater scrutiny of merger and acquisition (M&A) deals, especially in the U.K Yet, in the longer term, U.S.

Benzinga

JULY 26, 2022

What Happened: The Virtual Currency Fairness Act , introduced by Sens. A bill has been introduced to the U.S. Senate that would make small cryptocurrency transactions exempt from capital gains taxes.

Musings on Markets

JANUARY 27, 2022

By the end of 2021, it was clear that this bout of inflation was not as transient a phenomenon as some had made it out to be, and the big question leading in 2022, for investors and markets, is how inflation will play out during the year, and beyond, and the consequences for stocks, bonds and currencies.

Financial Times M&A

OCTOBER 14, 2022

The relentless rise of the dollar has boosted the buying power of investors with funding in the US currency

Henry Horne

MARCH 24, 2022

Originally coined in 2009, Virtual Currency refers to “a digital representation of value that functions as a medium of exchange, a unit of account and/or a store of value.” ” In some environments, it operates like real currency, but it does not have legal tender status in the United States.

Benzinga

JANUARY 19, 2023

Coinbase Global, Inc (NASDAQ: COIN ) reportedly hired Lazard, Ltd (NYSE: LAZ ) advisors as it explored a potential sale that would remove it from Barry Silbert's Digital Currency Group (DCG). CEO Kevin Worth's email acknowledged receiving numerous inbound indications of interest in CoinDesk, CNBC reports.

Harvard Corporate Governance

MARCH 15, 2023

It is a great pleasure to be here with you, the great public servants of the Office of the Comptroller of the Currency. This post is based on his recent keynote address. It is also particularly humbling for a securities law professor. My work is about markets, and market integrity.

N Contracts

JUNE 9, 2023

This n ew vendor management guidance from the federal regulatory agencies aligns vendor management requirements among the Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), and the Federal Reserve and replaces existing guidance.

Law 360 M&A

FEBRUARY 23, 2024

The Office of the Comptroller of the Currency's proposed changes to the agency's bank merger review process could exacerbate industry concerns with long and unpredictable processing periods because the proposal is ambiguous with respect to how the OCC will view certain transactions, say attorneys at Simpson Thacher.

Harvard Corporate Governance

NOVEMBER 16, 2022

Written nearly four millennia ago, the code included various provisions about borrowing, lending, and interest rates related to silver and grain, the currencies of the day. [3] That brings me to the second text, one written in stone: the Hammurabi Code. more…).

Musings on Markets

JANUARY 24, 2024

That same phenomenon played out in other currencies, as government bond rates rose in Europe and Asia during the year, ravaging bond markets globally. Other Currencies The rise in interest rates that I chronicled for the United States played out in other currencies, as well.

Benzinga

DECEMBER 19, 2023

Genesis won a bid to block its parent company, the Barry Silbert -led Digital Currency Group (DCG) , from selling or reducing ownership in the company.

Law 360 M&A

JANUARY 29, 2024

The Office of the Comptroller of the Currency's acting chief said Monday that his agency will seek to improve the transparency of its bank merger review process by sketching out what kinds of deals are likely to get greenlit while at the same time scrapping a mechanism that allows for automatic approvals.

LaPorte

APRIL 4, 2023

The Office of the Comptroller of the Currency, Federal Deposit Insurance Corporation and Federal Reserve have zeroed in on numerous regulatory changes for 2023. The post Banking regulatory tide set to turn in 2023 first appeared on LaPorte.

Appraisers Blog

APRIL 24, 2023

The advice online is to file a complaint – with your state’s appraisal board, the Office of Comptroller of the Currency, the Consumer Financial Protection Bureau, and the FDIC. I have done only initial research on this topic, and have not yet acted on it. I hope everyone starts filing complaints.

Appraisers Blog

APRIL 24, 2023

The advice online is to file a complaint – with your state’s appraisal board, the Office of Comptroller of the Currency, the Consumer Financial Protection Bureau, and the FDIC. I have done only initial research on this topic, and have not yet acted on it. I hope everyone starts filing complaints.

Harvard Corporate Governance

MAY 12, 2022

Swaps emerged in the 1980s to provide producers and merchants with a way to lock in the price of commodities, interest rates, and currency rates. As is customary, I’d like to note that I’m not speaking on behalf of my fellow Commissioners or the SEC staff.

Musings on Markets

JULY 13, 2022

Country Risk: Currency and Cost of Capital As a final part to this post, to see the shifts in country risk that we have seen in 2022, let’s start with an assessment of risk free rates. That increase in interest rates is not restricted to the US dollar, as local currency government bond rates have risen around the world.

Harvard Corporate Governance

MAY 31, 2022

The Office of the Comptroller of the Currency found that the Wells Fargo board had known about fudged sales numbers for eleven years before the scandal broke. For outsiders, the aftermath was shocking; regulators fined Wells Fargo $3 billion and Wells Fargo fired 5,300 employees.

Norman Marks

FEBRUARY 20, 2023

Too many want to quantify every risk in dollars (or other currency) as if they were equal. Following up on last week’s post, there is one major problem that I haven’t talked about before. But they are not. Maybe they avoid the trap of multiplying one possible impact by its likelihood. That is wrong for […]

Business Wire M&A

MAY 22, 2023

ThinkMarkets provides its customers with access to over 10,000 CFDs, including but not limited to, equities, currencies, precious metals, indic (TSX: FGAA.U) (TSX: FGAA.WT.U) has entered into a business combination agreement with ThinkMarkets, one of the fastest growing online and leveraged trading multi-asset brokerages globally.

ThomsonReuters

MAY 6, 2021

2020 – Move Virtual Currency Question to 1040, page 1 and IRS sends out second round of notices to crypto taxpayers. 2019 – IRS sends out the first round of notices to crypto taxpayers and adds a Virtual Currency Question to 1040, Schedule 1. 2017 – Courts rule in favor of the IRS and Coinbase provides records.

Benzinga

MAY 9, 2023

On a constant currency basis, total net sales decreased by 0.5%, with a decrease of 1.2% Tempur Sealy International Inc (NYSE: TPX ) reported a first-quarter FY23 sales decline of 2.5% year-on-year to $1.208 billion, almost in line with the consensus of $1.210 billion. in the North American business segment and.

Law 360 M&A

AUGUST 3, 2023

New Jersey-based OceanFirst Bank needs to improve community lending practices, according to a recently released evaluation from the Office of the Comptroller of the Currency, findings released just months after the bank withdrew from a major merger.

Law 360 M&A

OCTOBER 20, 2022

billion) from 161 billion kronor offered in May, which was equal to about $16 billion before currency fluctuations in the interim. Tobacco giant Philip Morris on Thursday said it has increased its offer price for smaller peer Swedish Match AB to 176.4 billion Swedish kronor ($15.8

Benzinga

FEBRUARY 10, 2023

Global Payments Inc (NYSE: GPN ) reported fourth-quarter FY22 adjusted net revenue growth of 2% year-on-year (4% Y/Y in constant currency) to $2.02 billion, beating the consensus of $2.01 The adjusted operating margin expanded 240 basis points to 44.4%. Adjusted EPS of $2.42 beat the consensus of $2.41.

Benzinga

APRIL 11, 2023

On a constant currency basis, quarterly revenue totaled $154.2 Tilray Brands Inc (NASDAQ: TLRY ) shares are trading lower Tuesday after the cannabis company reported fiscal third-quarter results and announced an acquisition of HEXO Corp (NASDAQ: HEXO ). What Happened: Tilray said third-quarter revenue came in at $145.6

Financial Times M&A

DECEMBER 5, 2022

Plus, Vodafone’s CEO packs up his desk and Digital Currency Group’s FTX-esque fiasco

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content