The Credit Analyst Career Path: How to Get Into Finance Through the Side Door

Brian DeChesare

SEPTEMBER 14, 2022

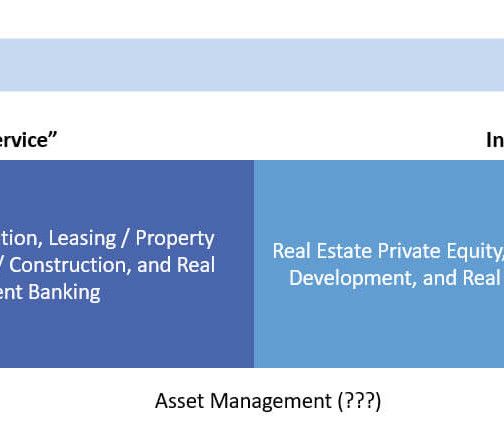

One of the problems with discussing credit analyst roles and the credit analyst career path is that no one agrees on what they mean. Adding to the confusion is the presence of jobs with very similar names, such as “credit risk analyst,” “credit specialist,” and “loan officer.”.

Let's personalize your content