Comment on Low Value = Material Deficiencies? New FHA ROV Policy by Rose

Appraisers Blog

MAY 4, 2024

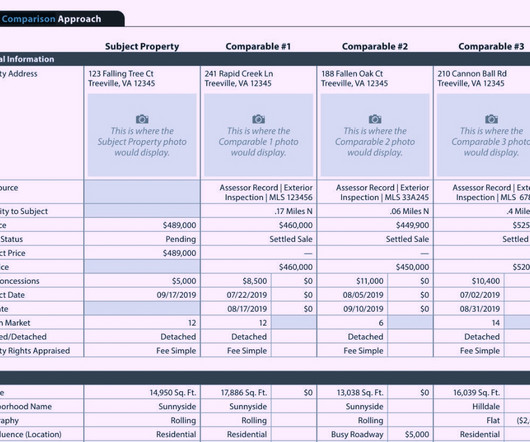

Appraiser who start out with a blank canvas (so to speak), with no asking price information provided to them, — obtaining data only by available visual information and records of the property and improvements itself, to work up the estimate and appropriate comps. In reply to Spencer Paul.

Let's personalize your content