First Look at PvP Disclosure Trends From the 2023 Proxy Season

Harvard Corporate Governance

JUNE 7, 2023

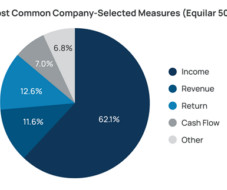

Posted by Amit Batish, Equilar, Inc., on Wednesday, June 7, 2023 Editor's Note: Amit Batish is Senior Director of Content at Equilar, Inc. Over the last few months, public companies across the U.S. public companies by revenue. This post is by Mr. Batish and Courtney Yu. more…)

Let's personalize your content