Standardization and Innovation in Venture Capital Contracting: Evidence from Startup Company Charters

Harvard Corporate Governance

OCTOBER 17, 2023

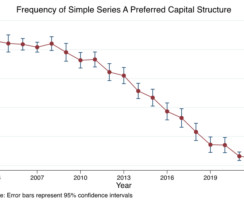

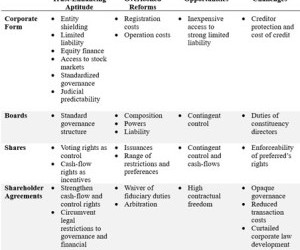

In 2003, a group of approximately two dozen lawyers specializing in venture capital (VC) finance embarked on a mission to standardize the financing documents utilized by VC firms for investments in US-based startups. In a forthcoming chapter written for The Research Handbook on the Structure of Private Equity and Venture Capital (B.

Let's personalize your content